Georgia Last Will and Testament

State of Georgia

State of Georgia

Overview:

- Create Your Georgia Last Will and Testament

- Understanding the Importance of a Last Will and Testament

- Simplified Explanation of Legal Concepts

- Key Requirements for a Valid Will in Georgia

- Is Notarization Required for Your Georgia Last Will?

- Types of Wills Recognized in Georgia

- Is a Handwritten Last Will Valid in Georgia?

- Sample of an Georgia Last Will and Testament

- Benefits of Having a Last Will and Testament

- Consequences of Not Having a Last Will and Testament

- Requirements for Executors of Last Wills in Georgia

- Creating Your Last Will and Testament

- Modifying or Canceling Your Last Will in Georgia

- Navigating Probate in Georgia

- Understanding Intestate Succession in Georgia

- Understanding Estate and Inheritance Taxes inGeorgia

- FAQs About Georgia Last Will and Testaments

- Testimonials

- Conclusion

- Download Your Georgia Last Will and Testament

- Author's Expertise

- Legal References and Sources

- Legal Disclaimer

Create Your Last Will and Testament

Creating your Last Will and Testament in Georgia is an essential step in ensuring your final wishes are honored and your loved ones are cared for according to your desires. Understanding Georgia's legal requirements is key to drafting a valid and effective will that clearly outlines the distribution of your assets, the guardianship of any minor children, and any other personal directives you wish to include. This legal document acts as the foundation of your estate planning, allowing you to express your intentions for how your estate should be managed and distributed after your passing.

Taking the initiative to establish your Last Will and Testament in Georgia showcases a responsible approach to estate planning, offering you and your family peace of mind. It's important to meticulously consider each aspect of your will to ensure it aligns with state laws and accurately reflects your wishes. A well-crafted will can prevent potential conflicts among heirs and provide clear guidance during a time that can be challenging for your loved ones, ultimately safeguarding your legacy and facilitating a smoother transition.

Understanding the Importance of a Last Will and Testament

Understanding the importance of a Last Will and Testament is crucial for ensuring that your final wishes regarding your assets, guardianship of minor children, and other personal decisions are respected and carried out after your passing. A will allows you to decide precisely who inherits your estate, minimizing the chance of family disputes and ensuring your possessions go to the intended beneficiaries rather than being distributed based on state laws, which may not align with your wishes.

Moreover, a Last Will and Testament facilitates the probate process, potentially reducing the time and expenses involved in validating your will and distributing your estate. It also enables you to appoint a trusted executor who will manage your estate, pay off any debts, and distribute your assets according to your wishes. For those with minor children or pets, a will is essential for appointing guardians, ensuring they are cared for by someone you trust in the event of your untimely demise.

Neglecting to create a will can lead to unintended consequences, including the government deciding how your estate is divided, which may not reflect your personal relationships or wishes. Therefore, having a Last Will and Testament is a fundamental aspect of estate planning, offering peace of mind to you and your loved ones by clearly outlining your wishes and ensuring they are honored.

Simplified Explanation of Legal Concepts

Let's simplify some essential legal terms related to creating a Last Will and Testament in Georgia, to enhance understanding for better comprehension.

Testator: In Georgia, the testator is the person who creates the Will, effectively laying out their final wishes. To be a testator in Georgia, you must be at least 14 years old and of sound mind, a bit younger than in many other states.

Witnesses: Witnesses are crucial in the Will-making process, as they observe the testator signing the Will and affirm its validity. Georgia requires at least two witnesses, who must be competent and at least 14 years old, to witness the signing of the Will and affirm that the testator was of sound mind and acting voluntarily.

Intestacy Laws: Should someone die without a valid Will in Georgia, the state's intestacy laws come into play. These laws outline a default distribution plan for the deceased's estate, typically favoring spouses, children, and then other relatives, according to a specific legal order.

Guardianship: In a Will, a Georgia testator can designate a guardian for their minor children, should both parents pass away. This allows the testator to ensure that their children are cared for according to their personal wishes and values.

Notarization: While not strictly required in Georgia for a Will to be valid, notarization, performed by a notary public, can add an extra layer of verification to the document. It involves confirming the identities of the signatories and their voluntary participation in the signing.

Beneficiaries: Beneficiaries are the individuals or entities chosen by the testator to inherit parts of their estate. In Georgia, these can include anyone the testator selects, from family members to friends, or even organizations and charities.

Estate Planning: This broader process encompasses the preparation for the management and distribution of a person's estate after their death. In Georgia, creating a Last Will and Testament is a key component of estate planning, ensuring the testator's wishes are respected and followed.

By understanding these key terms and their roles in the process, Georgians can navigate the complexities of estate planning with greater confidence and clarity.

Key Requirements for a Valid Will in Georgia

-

Age and Capacity: You must be at least 14 years old and of sound mind to create a will. This means you understand the implications of making the will and are doing so voluntarily, without any coercion or undue influence.

-

Written Document: The will must be in a written format. This can be either typed or handwritten, but oral wills or purely digital versions (like audio or video recordings) are not recognized.

-

Signature: The person making the will (the testator) must sign it. If you're unable to sign it yourself due to a physical condition, you can direct someone else to sign on your behalf in your presence.

-

Witnesses: Two witnesses, who are at least 14 years old and understand the nature of the document they are witnessing, must sign the will in the presence of the testator. It's recommended, though not legally required, that witnesses be at least 18 years old as a best practice. While beneficiaries can be witnesses, it's generally advised to have disinterested parties to avoid potential conflicts.

- Optional Notarization: While not required, notarizing the will can make it a self-proving document, which can simplify and expedite the probate process.

Is Notarization Required for Your Georgia Last Will?

Notarization is not a mandatory requirement for a Last Will and Testament to be considered valid in Georgia. According to the legal requirements set forth in the state, a will primarily needs to be in writing, signed by the testator (the person making the will), and witnessed by at least two individuals who are at least 14 years old and who sign the document in the presence of the testator.

However, while notarization isn't required, having a will notarized can make it a "self-proving" will. A self-proving will has an attached affidavit from the witnesses, which is notarized and can expedite the probate process because the court can accept the will without needing to contact the witnesses who signed it. This can be particularly helpful in ensuring that the probate process goes smoothly and without unnecessary delays.

Types of Wills Recognized in Georgia

In Georgia, the most commonly recognized type of will is the traditional written will, which needs to be in writing, signed by the testator, and witnessed by at least two individuals. This type of will can include a self-proving affidavit, which, while not a requirement, can help simplify the probate process. It's important to note that the testator must be at least 14 years old and of sound mind when signing the will.

Georgia law does not recognize non-cupative (oral) wills or holographic wills (those handwritten and signed by the testator without witnesses). If you're considering creating a will, it's crucial to ensure that it adheres to Georgia's specific legal requirements to be deemed valid.

For a broader understanding of will types beyond those recognized in Georgia, such as testamentary trust wills, joint wills, and living wills, you might find it beneficial to explore various will structures. Each has its purpose and suitability depending on individual circumstances and estate planning goals. While not all these types might be valid or applicable in Georgia, understanding them can provide valuable insights into estate planning options and considerations.

Is a Handwritten Last Will Valid in Georgia?

In Georgia, a handwritten will, also known as a holographic will, is not considered valid unless it meets the standard legal requirements for wills in the state. This means that even if a will is written entirely in the testator's handwriting, it must still be witnessed by at least two individuals who are not beneficiaries of the will and who are present at the time the testator signs the will. The witnesses must be at least 14 years old

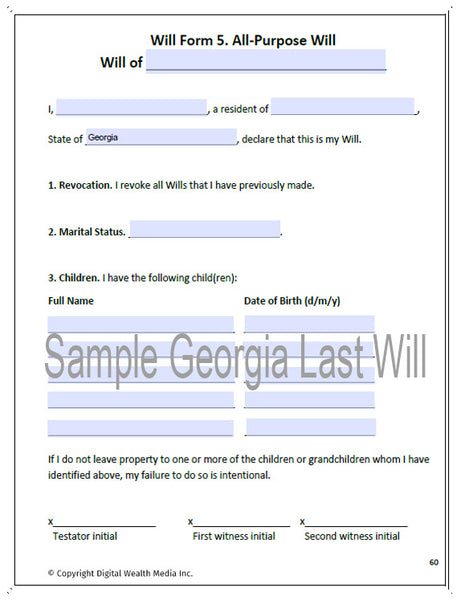

Sample of an Georgia Last Will and Testament

Experience the tranquility that accompanies proactive planning for your future by delving into a sample Georgia Last Will and Testament. This essential legal document establishes the blueprint for the dispersal of your assets, guaranteeing that your ultimate desires are honored. Take the first step in securing your legacy and offering clarity to your loved ones and beneficiaries. Begin fortifying your future today.

Benefits of Having a Last Will and Testament

Having a Last Will and Testament offers several crucial benefits:

-

Control Over Asset Distribution: A Will allows you to dictate how your assets are distributed after your passing. This ensures that your belongings go to the individuals or organizations you choose, rather than being decided by intestacy laws.

-

Protection of Loved Ones: With a Will, you can provide for your family and loved ones according to your wishes. This includes appointing guardians for minor children, ensuring their care and upbringing as you desire.

-

Avoidance of Family Disputes: Clearly outlining your wishes in a Will can help prevent conflicts among family members regarding asset distribution. This can alleviate potential stress and tension during an already difficult time.

-

Efficient Probate Process: A well-drafted Will can streamline the probate process, making it easier and faster for your estate to be administered. This can potentially reduce costs and delays for your beneficiaries.

-

Charitable Giving: If you wish to leave a portion of your estate to charity, a Will allows you to specify the organizations and amounts you'd like to donate. This can leave a lasting impact on causes that are important to you.

-

Appointment of Executors: In your Will, you can designate an executor to handle the administration of your estate. This ensures that someone you trust will manage your affairs and carry out your wishes.

- Flexibility and Customization: Your Will can be tailored to your specific needs and circumstances, allowing you to include provisions for unique situations or concerns.

Overall, having a Last Will and Testament provides peace of mind by ensuring that your wishes are documented and legally binding, thereby safeguarding your legacy and providing clarity for your loved ones.

Creating Your Last Will and Testament

Creating your Last Will and Testament is a significant step in ensuring that your final wishes are carried out and your loved ones are provided for after your passing. Here are the general steps to create your Will:

-

Gather Information: Compile a list of your assets, including real estate, bank accounts, investments, personal property, and any other valuable possessions. Also, consider who you want to inherit these assets and any specific bequests you wish to make.

-

Choose an Executor: Select a trustworthy individual to serve as the executor of your Will. This person will be responsible for managing your estate, paying debts and taxes, and distributing assets to your beneficiaries according to your instructions.

-

Decide on Guardianship: If you have minor children or dependents, designate guardians who will assume responsibility for their care and upbringing in the event of your death.

-

Draft Your Will: You can create your Will using various methods, such as hiring an attorney specializing in estate planning, using online templates and software, or writing your Will yourself. Ensure that your Will adheres to the legal requirements of your state.

-

Include Necessary Provisions: Your Will should clearly state how you want your assets to be distributed among your beneficiaries. Specify any conditions or restrictions on inheritances, such as age requirements or the establishment of trusts.

-

Sign and Execute Your Will: In the presence of witnesses, sign your Will to make it legally binding. Depending on your state's laws, you may need to have your Will notarized as well.

-

Store Your Will Safely: Keep your original Will in a secure location, such as a safe deposit box or with your attorney. Ensure that your executor knows where to find the Will and provide them with a copy for reference.

-

Review and Update Regularly: Periodically review your Will to ensure that it accurately reflects your current wishes and circumstances. Life events such as marriage, divorce, birth of children, or significant changes in assets may necessitate updates to your Will.

- Communicate Your Wishes: It's essential to communicate with your loved ones about your Will and your intentions regarding the distribution of your assets. This can help prevent misunderstandings and disputes among family members after your passing.

Creating your Last Will and Testament can provide peace of mind knowing that your affairs are in order and your loved ones are cared for according to your wishes. If you're unsure about the process or legal requirements, consider seeking guidance from an estate planning attorney to ensure that your Will is properly drafted and executed.

Modifying or Canceling Your Last Will in Georgia

In Georgia, you have the legal right to modify or cancel your Last Will and Testament at any time, provided you are of sound mind and meet certain legal requirements. Here's how you can go about modifying or canceling your Will:

Modifying Your Will: Create a Codicil: If you want to make minor changes to your existing Will, you can create a codicil. A codicil is a legal document that amends specific provisions of your Will while leaving the rest intact. It must comply with the same formalities as your original Will.

Consult an Attorney: While it's possible to draft a codicil yourself, it's advisable to consult with an estate planning attorney to ensure that the changes are properly executed and legally binding.

Sign and Execute the Codicil: Like your original Will, the codicil must be signed in the presence of witnesses and, depending on state law, may need to be notarized.

Attach the Codicil to Your Will: Once executed, attach the codicil to your original Will to ensure that your updated instructions are readily accessible and considered together with the main document.

Canceling Your Will: Create a Revocation Document: To cancel your entire Will, you can draft a revocation document expressing your intent to nullify all previous Wills and testamentary documents.

Destroy the Original Will: You can revoke your Will by destroying the original document with the intention of revoking it. This can include tearing, burning, or otherwise obliterating the document.

Notify Relevant Parties: Inform your executor, attorney, and any other relevant parties of your decision to revoke your Will to prevent confusion or disputes after your passing.

Create a New Will: If you intend to replace your canceled Will with a new one, ensure that the new document is properly drafted, executed, and stored according to legal requirements.

Legal Considerations: Date and Sign: Any modifications, codicils, or revocations must be dated and signed in accordance with Georgia's legal requirements.

Witnesses: Georgia law typically requires at least two witnesses to witness the signing of a Will, codicil, or revocation document. Notarization may also be necessary for certain documents.

Keep Records: Maintain clear records of all changes made to your Will, including the original document, any codicils, revocation documents, and related correspondence.

It's important to approach modifications or cancellations of your Will with careful consideration and to ensure that all legal formalities are followed to avoid potential disputes or challenges to your estate plan. Consulting with an experienced estate planning attorney can provide guidance tailored to your specific circumstances and ensure that your wishes are properly documented and executed under Georgia law.

Navigating Probate in Georgia

Navigating probate in Georgia involves several steps and considerations. Here's an overview of the process:

1. Filing the Will and Petition:

- File the Will: The first step is to file the deceased person's original Will with the probate court in the county where they resided at the time of their death. If there is no Will, the court will proceed with intestate succession laws.

- File a Petition for Probate: Along with the Will, you'll need to file a petition for probate, which formally requests the court to recognize the Will and appoint an executor or personal representative to administer the estate.

2. Appointment of Executor/Administrator:

- Court Hearing: The probate court will schedule a hearing to review the Will and appoint an executor if one is named in the Will. If no executor is named or willing to serve, the court will appoint an administrator to oversee the estate.

- Letters Testamentary/Letters of Administration: Once appointed, the executor or administrator will receive letters testamentary (for executors named in the Will) or letters of administration (for court-appointed administrators), granting them authority to act on behalf of the estate.

3. Inventory and Appraisal:

- Compile Inventory: The executor/administrator is responsible for creating an inventory of the deceased person's assets, including real estate, bank accounts, investments, personal property, and other belongings.

- Appraisal: Certain assets may require professional appraisal to determine their fair market value, especially real estate and valuable personal property.

4. Payment of Debts and Taxes:

- Notify Creditors: The executor/administrator must notify creditors of the estate's opening and may publish a notice in a local newspaper to inform potential creditors.

- Debt Payment: Debts and taxes owed by the deceased person's estate must be paid from estate funds before distributing assets to beneficiaries.

5. Distribution of Assets:

- Final Accounting: The executor/administrator prepares a final accounting of the estate's assets, debts, and expenses for approval by the probate court.

- Distribution to Beneficiaries: Once debts and taxes are paid, the remaining assets are distributed to beneficiaries according to the terms of the Will or intestate succession laws.

6. Closing the Estate:

- Final Report: The executor/administrator submits a final report to the probate court detailing the administration of the estate.

- Court Approval: After reviewing the final report, the probate court issues an order approving the distribution of assets and closing the estate.

Legal Assistance:

Navigating probate in Georgia can be complex, and it's advisable to seek legal assistance from an experienced probate attorney to ensure compliance with state laws and expedite the process. An attorney can provide guidance tailored to your specific circumstances and help address any challenges that may arise during probate proceedings.

Understanding Intestate Succession in Georgia

Intestate succession in Georgia refers to the legal process by which the assets of a deceased person are distributed when they die without a valid Last Will and Testament. In such cases, the state's laws dictate how the deceased person's estate is divided among their heirs. The specific rules of intestate succession in Georgia are outlined in the Georgia Code, Title 53, Chapter 2.

Under Georgia's intestacy laws, the distribution of assets typically prioritizes the deceased person's closest relatives, such as their spouse, children, parents, and siblings, in a specific order of priority. For example, if the deceased person is survived by a spouse but no children, the spouse would inherit the entire estate. However, if the deceased person is survived by both a spouse and children, the estate is divided between them according to a set formula outlined in the law.

If the deceased person has no surviving spouse, children, parents, or siblings, the estate may pass to more distant relatives, such as nieces, nephews, or grandparents, depending on the specific familial relationships and the absence of closer relatives. In cases where no living relatives can be identified, the estate may escheat to the state of Georgia.

It's important to note that intestate succession laws vary from state to state, and the distribution of assets under intestacy may not align with the deceased person's preferences or intentions. To avoid the uncertainties of intestacy and ensure that your assets are distributed according to your wishes, it's essential to create a valid Last Will and Testament with the assistance of an experienced estate planning attorney.

Understanding Estate and Inheritance Taxes in Georgia

In Georgia, estate taxes and inheritance taxes are not levied at the state level. Therefore, individuals do not need to worry about state estate or inheritance taxes on assets they leave behind. However, it's crucial to note that federal estate taxes may still apply to larger estates. The federal estate tax threshold is quite high, and only estates with a total value exceeding the exemption amount set by the Internal Revenue Service (IRS) are subject to federal estate taxes. As of 2022, the federal estate tax exemption is $12.06 million per individual, meaning that estates valued below this threshold are not subject to federal estate taxes. Additionally, assets passing to a surviving spouse are typically exempt from federal estate taxes due to the unlimited marital deduction. Nevertheless, it's essential for individuals with substantial estates to engage in estate planning strategies to minimize potential tax liabilities and ensure their assets are passed on efficiently to their intended beneficiaries. Consulting with an experienced estate planning attorney or financial advisor can provide valuable guidance on navigating tax implications and developing an effective estate plan tailored to individual circumstances in Georgia.

FAQs About Georgia Last Will and Testaments

Here are some frequently asked questions (FAQs) about Last Will and Testaments in Georgia:

1. What is a Last Will and Testament?

A Last Will and Testament is a legal document that outlines an individual's wishes regarding the distribution of their assets and the care of their minor children or dependents after their death.

2. Do I Need a Will in Georgia?

While not required by law, having a Will in Georgia is highly recommended, as it allows you to dictate how your assets will be distributed and ensures that your wishes are followed after your passing.

3. Who Can Create a Will in Georgia?

Any individual who is at least 18 years old and of sound mind can create a Will in Georgia. It's advisable to seek legal guidance to ensure that your Will complies with state laws and is properly executed.

4. What Happens if I Die Without a Will in Georgia?

If you die without a Will in Georgia, your assets will be distributed according to the state's intestacy laws, which may not align with your preferences. This can result in delays, disputes, and unintended beneficiaries.

5. Can I Change My Will?

Yes, you can change or update your Will at any time by creating a codicil (an amendment) or drafting a new Will. It's important to follow the proper legal procedures and execute any changes with the same formalities as your original Will.

6. How Do I Ensure My Will Is Valid in Georgia?

To ensure that your Will is valid in Georgia, it must be in writing, signed by you (the testator), and witnessed by at least two competent individuals who are not beneficiaries named in the Will. Notarization is not required but can provide additional evidence of authenticity.

7. Where Should I Keep My Will?

It's essential to keep your original Will in a safe and accessible location, such as a fireproof safe or with your attorney. Make sure your executor knows where to find the Will and consider providing them with a copy for reference.

8. Can I Disinherit Someone in My Will?

Yes, you have the right to disinherit individuals from your Will in Georgia, but it's crucial to clearly express your intentions to avoid potential challenges or disputes after your passing.

9. How Can I Get Help with Creating a Will in Georgia?

You can seek assistance from an experienced estate planning attorney in Georgia who can provide personalized guidance and ensure that your Will accurately reflects your wishes and complies with state laws.

These FAQs offer basic guidance on Last Will and Testaments in Georgia, but it's advisable to consult with a legal professional for personalized advice tailored to your specific circumstances.

Testimonials

Here are some testimonials from individuals who have successfully utilized the guidance provided in this article to create their Will:

Testimonial from Katie M.

“We are all accustomed to the necessity of final wills and living testaments, but the idea of a “digital will” is not quite so familiar. We may not realize we have important digital information and online assets in the form of social media accounts, photos in the cloud, web membership sites, writings and files on our computers. For anyone living in the digital age, a digital will is essential to ensure that our online assets are properly dealt with by our loved ones and beneficiaries.”

Testimonial from Jessica R.

“Amazing concept and very useful! Will get started.”

Conclusion

Creating a Last Will and Testament in Georgia is a crucial step in ensuring that your final wishes are honored and your loved ones are provided for after your passing. By drafting a clear and legally valid Will, you have the power to dictate how your assets will be distributed, appoint guardians for minor children, and mitigate potential disputes among family members. While not legally required, having a Will offers peace of mind and certainty, avoiding the uncertainties and complications that can arise from intestacy. Whether you're young or old, wealthy or of modest means, taking the time to create a Will with the assistance of an experienced estate planning attorney ensures that your legacy is preserved and your loved ones are protected according to your wishes. Start securing your future today by crafting a comprehensive Last Will and Testament that reflects your values, priorities, and desires for the legacy you leave behind.

Download Your Georgia Last Will and Testament

Begin your estate planning journey with confidence by securing your final wishes with our Georgia Last Will and Testament. Take control of your legacy and ensure that your assets are distributed according to your wishes with this easy-to-use guide and customizable template, tailored to Georgia state laws.

Craft a legally binding document that reflects your unique desires and priorities, including directives for asset distribution, guardianship, and more. Don't leave the fate of your estate to chance – download our Georgia Last Will and Testament today and embark on the path of comprehensive estate planning.

With our customizable template, you can create a personalized Will designed to meet your specific needs and preferences, providing clarity and peace of mind for yourself and your loved ones. Start planning for the future with confidence – download now and safeguard your legacy in Georgia.

Author's Expertise

Ivon T. Hughes designed Digital Wealth Media to greatly simplify the process so that more people can enjoy the peace of mind and wealth-building power of asset protection.

To further educate and help people, there is a treasure trove of asset protection articles and videos on the Digital Wealth Media website, along with a variety of wealth-protection packages that include Wills and other legal documents, including Digital Wills, which are something that just became necessary recently due to the continued expansion of the Internet.

Legal References and Sources

For those seeking additional information or validation regarding estate planning in Georgia, various legal references and official government sources offer comprehensive insights into Georgia state laws and procedures related to estate planning:

Georgia Code: The official website of the Georgia General Assembly provides access to the Georgia Code, which contains laws governing estate planning, Wills, and probate procedures in Georgia.

Georgia Probate Courts: The Georgia Probate Court Council website offers resources and information on probate proceedings, estate administration, and related legal matters. It also provides access to court forms and instructions for creating a Last Will and Testament.

State Bar of Georgia: The State Bar of Georgia website offers guidance on estate planning, including articles, FAQs, and resources for finding qualified attorneys specializing in estate planning and probate law in Georgia.

Georgia Department of Revenue: For information regarding estate taxes and other tax-related considerations relevant to estate planning in Georgia, the Georgia Department of Revenue website serves as an authoritative source.

Legal Aid Organizations: Legal aid organizations such as Atlanta Legal Aid Society and Georgia Legal Services Program offer assistance and resources for individuals seeking legal guidance on estate planning matters in Georgia.

These legal references and sources serve as valuable resources for individuals seeking to understand and comply with Georgia state laws governing estate planning and Last Will and Testament creation. It is advisable to consult these authoritative sources or seek professional legal advice for personalized guidance on specific estate planning issues in Georgia.

Legal Disclaimer

The information provided on this website is intended for educational purposes and general guidance only. It does not constitute legal advice specific to the laws of the State of Georgia or any other jurisdiction.

Laws related to estate planning, probate, and wills vary by state, and they are subject to change. The content presented here may not reflect the most current legal developments or regulations applicable in Georgia.

Readers are strongly advised to seek the assistance of a qualified attorney or legal professional licensed in Georgia to obtain personalized advice regarding their estate planning needs. Consulting with an attorney familiar with Georgia laws ensures that individuals receive accurate information and guidance tailored to their unique circumstances.

No attorney-client relationship is established by reading or acting upon the information contained on this website. The authors, publishers, and distributors of this content disclaim any liability for reliance on the information provided herein or for any loss or damage resulting from its use.

It is essential to conduct thorough research and obtain professional legal advice before making any decisions related to estate planning, including creating a Last Will and Testament, in the State of Georgia.