Illinois Last Will and Testament

State of Illinois

State of Illinois

Overview:

- Create Your Illinois Last Will and Testament

- Understanding the Importance of a Last Will and Testament

- Simplified Explanation of Legal Concepts

- Key Requirements for a Valid Will in Illinois

- Is Notarization Required for Your Illinois Last Will?

- Types of Wills Recognized in Illinois

- Is a Handwritten Last Will Valid in Illinois?

- Sample of an Illinois Last Will and Testament

- Benefits of Having a Last Will and Testament

- Consequences of Not Having a Last Will and Testament

- Requirements for Executors of Last Wills in Illinois

- Creating Your Last Will and Testament

- Modifying or Canceling Your Last Will in Illinois

- Navigating Probate in Illinois

- Understanding Intestate Succession in Illinois

- Understanding Estate and Inheritance Taxes in Illinois

- FAQs About Illinois Last Will and Testaments

- Testimonials

- Conclusion

- Download Your Illinois Last Will and Testament

- Author's Expertise

- Legal References and Sources

- Legal Disclaimer

Create Your Illinois Last Will and Testament

Crafting your Illinois Last Will and Testament is a crucial step in ensuring your final wishes are honored and your assets are distributed according to your desires. This essential legal document provides clear instructions on how your estate should be managed and allocated after your passing. By outlining your wishes for guardianship, asset distribution, and other important matters, you can provide peace of mind for yourself and your loved ones. Whether you're safeguarding your family's future or ensuring your philanthropic goals are met, creating a Last Will allows you to leave a lasting legacy while avoiding potential conflicts or uncertainties among your heirs.

In Illinois, the process of creating your Last Will and Testament involves several key steps, including identifying your assets, selecting beneficiaries, and appointing an executor to oversee the distribution of your estate. It's essential to ensure your Will complies with Illinois state laws and is properly executed to avoid any legal complications in the future. Consulting with a qualified attorney specializing in estate planning can provide valuable guidance and ensure your Will accurately reflects your intentions. By taking the time to create a comprehensive and legally sound Last Will, you can protect your legacy and provide clarity and security for your loved ones during a challenging time.

Understanding the Importance of a Last Will and Testament

A Last Will and Testament holds significant importance as a legal document that outlines your wishes for the distribution of your assets and the management of your affairs after your passing. By creating a Will, you can ensure that your estate is distributed according to your preferences, providing clarity and direction to your loved ones during a difficult time. Additionally, a Will allows you to appoint guardians for any minor children and designate an executor to oversee the administration of your estate, providing peace of mind that your affairs will be handled competently.

Moreover, a Last Will and Testament can help prevent potential conflicts among family members and minimize the likelihood of disputes over your estate. By clearly stating your intentions and the beneficiaries of your assets, you can reduce the risk of misunderstandings or disagreements among heirs. Additionally, a Will enables you to specify any charitable donations or special bequests, allowing you to support causes or individuals that are meaningful to you.

Overall, creating a Last Will and Testament is a vital aspect of estate planning that allows you to protect your legacy, provide for your loved ones, and ensure that your wishes are carried out according to your desires. By taking the time to create a Will, you can establish a comprehensive plan for the future and leave a lasting legacy for generations to come.

Simplified Explanation of Legal Concepts

Creating a Last Will and Testament in Illinois is a vital step in ensuring your final wishes are carried out and your loved ones are provided for after your passing. Understanding key legal terms related to this process can make it easier to navigate and ensure your Will accurately reflects your intentions. Here, we'll simplify essential concepts associated with crafting a Will in Illinois, helping you make informed decisions when preparing this crucial document.

-

Testator: The individual creating the Will, who must be at least 18 years old and of sound mind in Illinois.

-

Witnesses: People who observe the testator sign the Will and validate its authenticity. Illinois law typically requires two witnesses, who must be at least 18 years old and not beneficiaries.

-

Intestacy Laws: In the absence of a valid Will, Illinois intestacy laws dictate how an individual's estate is distributed, prioritizing spouses, children, and other close relatives according to a predetermined hierarchy.

-

Guardianship: Appointing a guardian for minor children in the event of both parents' deaths. Through a Will, the testator can designate a trusted individual to ensure their children are cared for according to their wishes.

-

Notarization: The process of having the Will's execution verified by a notary public, confirming the identities of the signatories and adding an extra layer of authenticity to the document.

-

Beneficiaries: The individuals or entities named in the Will to receive the testator's assets, which may include family members, friends, or charitable organizations selected by the testator.

- Estate Planning: Strategically organizing the management and distribution of one's assets after death. Drafting a Will is a fundamental aspect of estate planning in Illinois, ensuring that the testator's wishes are carried out effectively.

Understanding these essential legal terms can simplify the process of creating a Last Will and Testament in Illinois, allowing you to make informed decisions and ensure your final wishes are accurately documented and legally upheld. By familiarizing yourself with these concepts, you can navigate the complexities of estate planning with confidence, providing peace of mind for yourself and security for your loved ones.

Key Requirements for a Valid Will in Illinois

Creating a valid Last Will and Testament in Illinois requires adherence to specific legal requirements to ensure its legitimacy and enforceability. Here are the key requirements:

-

Legal Capacity: The testator must be of sound mind and at least 18 years old to create a Will in Illinois. Individuals who lack mental capacity or are under the age of 18 cannot create a valid Will.

-

Voluntariness: The Will must be created voluntarily, without coercion or undue influence from others. The testator must make decisions regarding the contents of the Will freely, based on their own wishes and intentions.

-

In Writing: A Will in Illinois must be in writing to be considered valid. While handwritten Wills (holographic Wills) are accepted in some states, Illinois requires typed or printed Wills to ensure clarity and prevent ambiguity.

-

Signature: The testator must sign the Will at the end of the document to indicate their approval and authentication of its contents. If the testator is physically unable to sign, they may direct another person to sign on their behalf in their presence and at their direction.

-

Witnesses: Illinois law requires at least two witnesses to attest to the testator's signature on the Will. Witnesses must be at least 18 years old and mentally competent, and they cannot be beneficiaries or related to beneficiaries named in the Will.

- Notarization (Optional): While not mandatory, having the Will notarized by a notary public can provide additional evidence of its validity and may streamline the probate process. However, notarization is not a substitute for the requirement of witness signatures.

Ensuring compliance with these key requirements is essential for creating a valid Will in Illinois. By following these guidelines, testators can have confidence that their final wishes will be legally upheld and accurately executed upon their passing.

Is Notarization Required for Your Illinois Last Will?

Notarization is not required for a Last Will and Testament to be valid in Illinois. While notarizing the Will can provide additional evidence of its authenticity and may streamline the probate process, it is not a mandatory requirement under Illinois law. Instead, the key elements for a valid Will in Illinois include the testator's signature, the signatures of at least two witnesses, and compliance with other legal requirements outlined by the state. Therefore, while notarization is optional, ensuring that the Will meets all other necessary criteria is essential for its validity and enforceability.

Types of Wills Recognized in Illinois

In Illinois, several types of Wills are recognized, each serving different purposes and accommodating various circumstances:

-

Simple Will: A Simple Will is the most common type and outlines the distribution of assets and the appointment of guardians for minor children. It is suitable for individuals with straightforward estates and uncomplicated family situations.

-

Joint Will: A Joint Will is created by two individuals, typically spouses, to leave their assets to each other and then to their chosen beneficiaries. While Joint Wills were once common, they are less favored now due to inflexibility and potential complications.

-

Testamentary Trust Will: This type of Will establishes one or more trusts to manage assets and distribute them to beneficiaries over time, often used to provide for minor children or individuals with special needs.

-

Living Will (Advance Healthcare Directive): While not a traditional Will, a Living Will outlines an individual's healthcare preferences and directives in the event they become incapacitated and unable to make medical decisions.

- Pour-Over Will: A Pour-Over Will is used in conjunction with a Revocable Living Trust, directing that any assets not already transferred to the trust during the individual's lifetime be transferred to it upon their death.

Understanding the different types of Wills available in Illinois allows individuals to choose the one that best aligns with their estate planning goals and family dynamics. It is advisable to consult with a legal professional to determine the most suitable Will for one's unique circumstances.

Is a Handwritten Last Will Valid in Illinois?

In Illinois, a handwritten Last Will, also known as a holographic Will, may be considered valid under certain circumstances. However, there are strict requirements that must be met for a handwritten Will to be legally recognized:

-

Entirely Handwritten: The entire Will must be handwritten by the testator, meaning it must be written in their own handwriting and not typed or printed.

-

Signed and Dated: The handwritten Will must be signed and dated by the testator. The signature serves as an indication of the testator's intent and acknowledgment of the document's contents.

-

No Witnesses Required: Unlike formal Wills, handwritten Wills in Illinois do not require witness signatures to be considered valid.

-

Clear Intent: The testator's intent must be clear and unambiguous in the handwritten document, indicating their wishes regarding the distribution of assets and other relevant matters.

- Capacity: The testator must have the mental capacity to understand the nature and consequences of creating a Will at the time of writing.

While handwritten Wills are recognized in Illinois, they are generally not recommended due to the potential for ambiguity, disputes, and challenges during probate. It is advisable to consult with a qualified estate planning attorney to ensure that your Will is legally valid and accurately reflects your wishes.

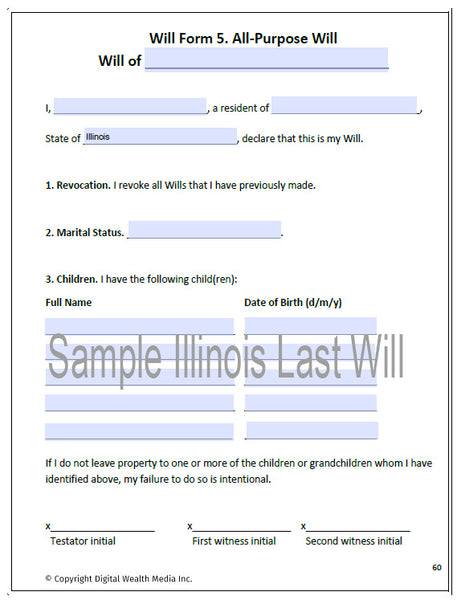

Sample of an Illinois Last Will and Testament

Prepare for the future and secure peace of mind with a sample Illinois Last Will and Testament. This critical legal document empowers you to dictate the distribution of your assets and ensure your final wishes are respected. Click below to access a sample Will tailored to Illinois law, taking the first step towards safeguarding your legacy and providing clarity for your loved ones.

Benefits of Having a Last Will and Testament

Crafting a Last Will and Testament offers several significant benefits, providing peace of mind and security for both you and your loved ones. Here are some key advantages:

-

Asset Distribution: A Will allows you to specify how your assets and property should be distributed after your passing. By outlining your wishes clearly, you can prevent potential conflicts among family members and ensure your possessions go to the intended beneficiaries.

-

Guardianship Arrangements: For parents with minor children, a Will provides the opportunity to designate a guardian. This ensures that your children are cared for by someone you trust, should anything happen to you and the other parent.

-

Executor Appointment: You can nominate an executor in your Will, who will be responsible for managing your estate and ensuring that your wishes are carried out as outlined. This individual acts as a personal representative and plays a crucial role in executing your Will.

-

Minimizing Legal Complications: Without a Will, your estate may be subject to intestacy laws, which dictate how assets are distributed among heirs. Crafting a Will helps to minimize legal complications and ensures that your estate is distributed according to your preferences.

- Peace of Mind: Having a Last Will and Testament provides peace of mind, knowing that you have taken proactive steps to plan for the future and protect your loved ones. It offers reassurance that your affairs will be handled according to your wishes, even after you're no longer present.

Overall, creating a Last Will and Testament is a vital component of estate planning, offering numerous benefits that extend beyond financial matters. It allows you to make informed decisions about your legacy, ensuring that your loved ones are provided for and your final wishes are honored.

Consequences of Not Having a Last Will and Testament

-

Intestacy Laws: Without a Will, your estate will be subject to intestacy laws, which vary depending on your jurisdiction. These laws dictate how your assets are distributed among your heirs, often following a predetermined hierarchy based on familial relationships. This may result in assets being distributed in a manner that differs from your preferences.

-

Lack of Control: Without a Will, you forfeit the opportunity to specify how your assets should be distributed. This means that decisions about your estate will be left to state laws and the probate court, rather than reflecting your personal wishes and intentions.

-

Family Disputes: Intestacy can lead to potential conflicts among family members, especially if there are disagreements about asset distribution. Without clear instructions provided in a Will, disputes may arise over who is entitled to inherit specific assets, potentially leading to costly and emotional legal battles.

-

Guardianship Issues: For parents with minor children, the absence of a Will means there is no designated guardian named to care for the children in the event of both parents' deaths. This can result in uncertainty and legal proceedings to determine guardianship, potentially leading to delays and stress for the children involved.

-

Increased Costs and Delays: Without a Will, the probate process may be prolonged and more complex, leading to increased costs and delays in the distribution of assets. Legal fees, court costs, and administrative expenses can diminish the value of the estate, reducing the inheritance received by beneficiaries.

- Unintended Beneficiaries: In the absence of clear instructions provided in a Will, assets may pass to unintended beneficiaries or distant relatives under intestacy laws. This can result in assets being distributed in a manner that does not align with your wishes or familial relationships.

Requirements for Executors of Last Wills in Illinois

In Illinois, the role of an executor, also known as a personal representative, is crucial in administering the estate according to the instructions outlined in the Last Will and Testament. Here are the key requirements for executors of Last Wills in Illinois:

-

Legal Capacity: The executor must be of legal age and possess the mental capacity to fulfill the responsibilities of the role. Generally, individuals aged 18 or older who are mentally competent can serve as executors.

-

Residency: While Illinois law does not explicitly require executors to be residents of the state, it is often advisable to appoint someone who is familiar with Illinois laws and procedures. Out-of-state executors may need to appoint an in-state agent to represent them in certain matters.

-

Trustworthiness: Executors are entrusted with significant responsibilities, including managing assets, paying debts and taxes, and distributing inheritances. As such, they must demonstrate honesty, integrity, and reliability in carrying out their duties.

-

Understanding of Duties: The executor should have a clear understanding of their responsibilities and obligations under Illinois law. This includes overseeing the probate process, locating and valuing assets, settling debts and taxes, and distributing assets to beneficiaries according to the terms of the Will.

-

Communication Skills: Effective communication is essential for executors to interact with beneficiaries, creditors, attorneys, and other parties involved in the estate administration process. Executors should be able to communicate clearly and professionally, providing updates and addressing concerns as needed.

-

Financial Literacy: While not mandatory, financial literacy can be beneficial for executors, especially when managing complex assets or investments. Executors may need to work with financial professionals, such as accountants or investment advisors, to fulfill their duties effectively.

- Legal Assistance: While executors are not required to have legal expertise, seeking guidance from an experienced estate planning attorney can help ensure compliance with Illinois probate laws and minimize the risk of errors or disputes during the estate administration process.

Overall, executors play a critical role in the probate process, and appointing a capable and qualified individual is essential for the efficient administration of a Last Will and Testament in Illinois.

Creating Your Last Will and Testament

Crafting your Last Will and Testament is a fundamental step in ensuring that your final wishes are carried out and your loved ones are provided for after your passing. Here's a simplified guide to creating your Last Will and Testament in Illinois:

-

Determine Your Assets and Beneficiaries: Start by identifying all your assets, including real estate, financial accounts, vehicles, personal belongings, and any other valuable possessions. Decide who you want to inherit these assets, whether they are family members, friends, or charitable organizations.

-

Choose an Executor: Select a trusted individual to serve as the executor of your Will. This person will be responsible for managing your estate, settling debts and taxes, and distributing assets to your beneficiaries according to your wishes.

-

Draft Your Will: You can create your Will using a template, online service, or with the assistance of an estate planning attorney. Clearly outline how you want your assets to be distributed among your beneficiaries. Be sure to include specific instructions for any unique or sentimental items.

-

Include Guardianship Provisions: If you have minor children, designate a guardian in your Will to care for them in the event of your passing. Discuss this decision with the chosen guardian beforehand to ensure their willingness to take on this responsibility.

-

Sign and Witness Your Will: In Illinois, your Will must be signed by you (the testator) in the presence of at least two competent witnesses who are not beneficiaries of the Will. The witnesses must also sign the Will to attest to its validity.

-

Consider Notarization: While notarization is not required for a Last Will and Testament to be valid in Illinois, having your Will notarized can provide an additional layer of authentication and may streamline the probate process.

- Review and Update Regularly: Periodically review your Will to ensure it accurately reflects your current wishes and circumstances. Life events such as marriage, divorce, birth of children, or changes in financial status may necessitate updates to your Will.

Creating your Last Will and Testament is a proactive way to safeguard your legacy and provide clarity and peace of mind for your loved ones during a challenging time. By following these steps and seeking professional guidance if needed, you can ensure that your final wishes are legally documented and upheld.

Modifying or Canceling Your Last Will in Illinois

In Illinois, you have the legal right to modify or cancel your Last Will and Testament at any time, provided you are of sound mind and meet certain legal requirements. Here's a simplified guide on how to modify or cancel your Will:

-

Create a Codicil: If you wish to make minor changes to your existing Will, such as updating beneficiaries or adding new assets, you can create a codicil. A codicil is a legal document that serves as an amendment to your original Will. It must be executed with the same formalities as your Will, including signatures from you and witnesses.

-

Draft a New Will: If you want to make significant changes to your estate plan or revoke your existing Will entirely, you can draft a new Will. Your new Will should clearly state that it revokes all previous Wills and codicils. Be sure to follow the same execution formalities as your original Will, including signing in the presence of witnesses.

-

Destroy Your Existing Will: Alternatively, you can revoke your existing Will by physically destroying it with the intent to cancel its legal effect. Common methods of revocation include tearing, shredding, or burning the document. It's essential to ensure that all copies of your Will are destroyed to prevent any confusion or disputes.

-

Notify Relevant Parties: After modifying or canceling your Will, it's crucial to inform your executor, beneficiaries, and any other relevant parties about the changes. This helps avoid confusion and ensures that your wishes are carried out correctly.

- Seek Legal Advice: If you're unsure about the best approach for modifying or canceling your Will, it's advisable to seek guidance from an experienced estate planning attorney. They can provide personalized advice based on your specific circumstances and ensure that your modifications comply with Illinois laws.

By following these steps and seeking professional assistance if needed, you can effectively modify or cancel your Last Will and Testament in Illinois to reflect your current wishes and circumstances. Regularly reviewing and updating your estate plan ensures that it remains aligned with your evolving needs and priorities.

Navigating Probate in Illinois

Navigating the probate process in Illinois involves several key steps. Firstly, the deceased person's Will must be filed with the appropriate county court. If a valid Will exists, the court appoints an executor to administer the estate; otherwise, an administrator is appointed.

Once appointed, the executor or administrator creates an inventory of the deceased person's assets, including real estate, bank accounts, investments, and personal property. This inventory forms the basis for distributing the estate to beneficiaries or heirs according to the Will or state law if there is no Will.

Creditors of the deceased must be notified, and they are given a specific timeframe to submit claims against the estate for any outstanding debts. The executor or administrator is responsible for paying off these debts, including taxes and funeral expenses, before distributing assets to beneficiaries.

After debts are settled, the remaining assets can be distributed to beneficiaries according to the terms of the Will or Illinois intestacy laws if there is no Will. The executor or administrator must ensure that assets are distributed fairly and in compliance with the law.

Finally, the executor or administrator prepares a final accounting of the estate's assets and expenses, which is submitted to the court for approval. Once approved, the probate case is closed, and the estate administration process is concluded. Seeking guidance from a probate attorney can help navigate this process smoothly and ensure that the deceased person's final wishes are carried out correctly.

Understanding Intestate Succession in Illinois

Intestate succession refers to the process of distributing a deceased person's assets when they pass away without a valid Will. In Illinois, intestate succession laws dictate how the deceased person's estate will be distributed among their heirs.

If someone dies intestate in Illinois and is survived by a spouse but no children, the entire estate passes to the surviving spouse. However, if the deceased person is survived by a spouse and children, the estate is divided between them. The surviving spouse receives half of the estate's value, with the remaining half divided equally among the children.

In cases where the deceased person has children but no surviving spouse, the estate is divided equally among the children. If the deceased person has neither a surviving spouse nor children, the estate passes to other relatives, such as parents, siblings, nieces, or nephews, in a predetermined order outlined by Illinois law. Understanding these intestacy laws is crucial for individuals who have not created a Will, as it determines how their assets will be distributed upon their death.

Understanding Estate and Inheritance Taxes in Illinois

In Illinois, estate and inheritance taxes are significant considerations for individuals planning their estates. While Illinois does not impose an estate tax on estates of decedents who passed away after January 1, 2010, it does have an inheritance tax. This tax applies to certain beneficiaries who inherit property from a deceased individual.

The inheritance tax rate varies based on the relationship between the decedent and the beneficiary. For example, property passing to a surviving spouse, parents, grandparents, children, stepchildren, or grandchildren is typically exempt from the inheritance tax. However, property passing to other beneficiaries, such as siblings, nieces, nephews, aunts, uncles, cousins, or unrelated individuals, may be subject to the tax.

Understanding these tax implications is crucial for estate planning to ensure that beneficiaries receive their intended inheritances with minimal tax consequences. Proper planning strategies can help minimize the impact of taxes on the distribution of assets, allowing individuals to preserve their wealth and provide for their loved ones effectively.

FAQs About Illinois Last Will and Testaments

Here are some frequently asked questions (FAQs) about Last Will and Testaments in Illinois:

1. What is a Last Will and Testament?

A Last Will and Testament, commonly referred to as a Will, is a legal document that allows individuals to specify how they want their assets and property distributed after their death.

2. Why do I need a Last Will and Testament?

Creating a Will ensures that your final wishes are legally documented and followed after your passing. It provides clarity on asset distribution and can help avoid potential conflicts among family members.

3. Who can create a Last Will and Testament in Illinois?

In Illinois, anyone who is of sound mind and at least 18 years old can create a Last Will and Testament.

4. What happens if I die without a Will in Illinois?

If you pass away without a Will in Illinois, your estate will be subject to intestacy laws, which dictate how your assets are distributed among your heirs. This may not align with your wishes and can lead to lengthy legal proceedings.

5. Can I modify my Last Will and Testament?

Yes, you can modify or update your Will at any time as long as you are of sound mind. This can be done through a codicil (an amendment to the existing Will) or by creating a new Will altogether.

6. Do I need to notarize my Last Will and Testament in Illinois?

A: While notarization is not required for a Last Will and Testament to be valid in Illinois, it can provide additional evidence of the document's authenticity and may be advisable in certain situations.

Testimonials

Here are some testimonials from individuals who have successfully utilized the guidance provided in this article to create their Will:

Testimonial from Anthony Mack

"I am glad to see that someone has finally developed a Digital Will to help us get all of this information together. It will help ease the difficulty when we are no longer here. The whole digital thing is affecting us more and more, though I never gave much thought until a recent death"

Testimonial from Ronald W.

“I have looked into "THE DIGITAL WILL" and am impressed with the necessity of it. For myself, it will allow my heirs to have access to my personal financial accounts. As well, my executor will now have access to my client data, which would be important for the benefit of my clients to have the backup they might need.”

Conclusion

In conclusion, having a Last Will and Testament in Illinois is a crucial step in estate planning that ensures your final wishes are upheld and your assets are distributed according to your preferences. By taking the time to create a Will, you can provide clarity and peace of mind for yourself and your loved ones, minimizing the potential for disputes and legal complications in the future. Whether you're young or old, having a Will in place offers invaluable protection and ensures that your legacy is preserved in the manner you desire. Don't delay in creating your Last Will and Testament to safeguard your estate and provide for your beneficiaries in Illinois.

Download Your Illinois Last Will and Testament

Ready to take charge of your estate planning and ensure your final wishes are legally recorded? Download our Illinois Last Will and Testament today and kick-start the process of crafting your personalized Will. With our easy-to-use guide and customizable template, you can confidently outline your preferences for asset distribution, guardianship, and more. Don't leave the fate of your legacy to chance – secure your future and offer peace of mind for yourself and your loved ones by creating a legally binding Will tailored to your unique requirements and desires. Download now and begin planning for the future.

Author's Expertise

Ivon T. Hughes designed Digital Wealth Media to greatly simplify the process so that more people can enjoy the peace of mind and wealth-building power of asset protection.

To further educate and help people, there is a treasure trove of asset protection articles and videos on the Digital Wealth Media website, along with a variety of wealth-protection packages that include Wills and other legal documents, including Digital Wills, which are something that just became necessary recently due to the continued expansion of the Internet.

Legal References and Sources

For those seeking additional information or validation regarding estate planning in Illinois, the following legal references and official government sources provide comprehensive insights into Illinois state laws and procedures related to estate planning:

Illinois Compiled Statutes: The official website of the Illinois General Assembly offers access to the Illinois Compiled Statutes, which encompass laws governing estate planning, Wills, and probate procedures in Illinois.

Illinois Probate Courts: The Illinois Courts website provides resources and information on probate proceedings, estate administration, and related legal matters. It also offers access to court forms and instructions for creating a Last Will and Testament.

Illinois State Bar Association: The Illinois State Bar Association website offers guidance on estate planning, including articles, FAQs, and resources for finding qualified attorneys specializing in estate planning and probate law in Illinois.

Illinois Department of Revenue: For information regarding estate taxes and other tax-related considerations relevant to estate planning in Illinois, the Illinois Department of Revenue website serves as an authoritative source.

Legal Aid Organizations: Legal aid organizations such as Illinois Legal Aid Online and Prairie State Legal Services offer assistance and resources for low-income individuals seeking legal guidance on estate planning matters in Illinois.

These legal references and sources serve as valuable resources for individuals seeking to understand and comply with Illinois state laws governing estate planning and Last Will and Testament creation. It is advisable to consult these authoritative sources or seek professional legal advice for personalized guidance on specific estate planning issues in Illinois.

Legal Disclaimer

The information provided on this website is intended for educational purposes and general guidance only. It does not constitute legal advice specific to the laws of the State of Illinois or any other jurisdiction.

Laws related to estate planning, probate, and wills vary by state, and they are subject to change. The content presented here may not reflect the most current legal developments or regulations applicable in Illinois.

Readers are strongly advised to seek the assistance of a qualified attorney or legal professional licensed in Illinois to obtain personalized advice regarding their estate planning needs. Consulting with an attorney familiar with Illinois laws ensures that individuals receive accurate information and guidance tailored to their unique circumstances.

No attorney-client relationship is established by reading or acting upon the information contained on this website. The authors, publishers, and distributors of this content disclaim any liability for reliance on the information provided herein or for any loss or damage resulting from its use.

It is essential to conduct thorough research and obtain professional legal advice before making any decisions related to estate planning, including creating a Last Will and Testament, in the State of Illinois.