New Jersey Last Will and Testament

State of New Jersey

Overview:

- Create Your New Jersey Last Will and Testament

- Understanding the Importance of a Last Will and Testament

- Simplified Explanation of Legal Concepts

- Key Requirements for a Valid Will in New Jersey

- Is Notarization Required for Your New Jersey Last Will?

- Types of Wills Recognized in New Jersey

- Is a Handwritten Last Will Valid in New Jersey?

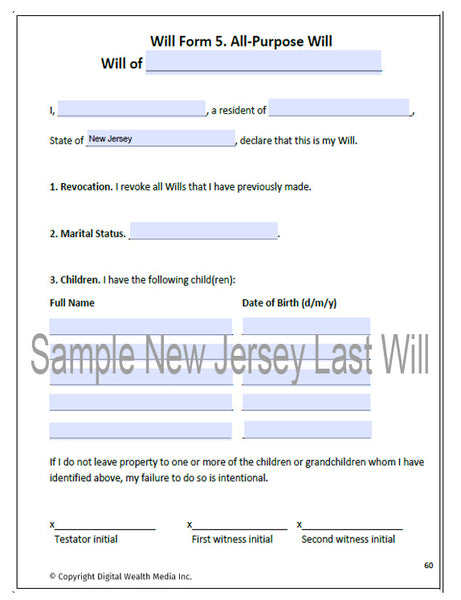

- Sample of an New Jersey Last Will and Testament

- Benefits of Having a Last Will and Testament

- Consequences of Not Having a Last Will and Testament

- Requirements for Executors of Last Wills in New Jersey

- Creating Your Last Will and Testament

- Modifying or Canceling Your Last Will in New Jersey

- Navigating Probate in New Jersey

- Understanding Intestate Succession in New Jersey

- Understanding Estate and Inheritance Taxes in New Jersey

- FAQs About New Jersey Last Will and Testaments

- Testimonials

- Conclusion

- Download Your New Jersey Last Will and Testament

- Author's Expertise

- Legal References and Sources

- Legal Disclaimer

Create Your New Jersey Last Will and Testament

Creating your Last Will and Testament is a pivotal step in managing your affairs and ensuring your assets are distributed according to your wishes in New Jersey. This legal document sets forth your instructions for the disposition of your property, the care of any minor children, and the appointment of an executor to manage the estate until its final distribution. With a well-crafted Will, you can provide clear guidance to your loved ones during a difficult time, potentially avoiding the complexities and disputes that can arise when a person passes away intestate, or without a Will, under New Jersey law.

In New Jersey, the process of creating a Will is straightforward, yet it requires careful consideration to ensure it reflects your intentions accurately and is legally valid. To be valid, a Will in New Jersey must be written by an individual who is at least 18 years old and of sound mind, signed by the testator (the person making the Will), and witnessed by at least two individuals who will not inherit anything under the Will. Taking the time to draft a Last Will and Testament not only secures your legacy but also provides peace of mind knowing that your final wishes will be honored and your loved ones taken care of according to your directives.

Understanding the Importance of a Last Will and Testament

A Last Will and Testament holds paramount importance as it serves as the foundational document for estate planning, ensuring that your assets and belongings are distributed according to your wishes upon your passing. Without a Will, the state laws of intestacy come into play, often leading to outcomes that might not align with your personal preferences or the needs of your beneficiaries. Particularly in diverse family structures or for those with specific bequests in mind, a Will provides a clear, legally binding directive that can prevent potential conflicts and ensure that your legacy is preserved and passed on as intended.

Moreover, a Last Will and Testament allows you to make critical decisions regarding the guardianship of minor children, a consideration of utmost importance for parents. In the absence of such specifications, the court will decide on guardianship matters, which may not reflect your desired arrangements. By appointing a guardian of your choice, you ensure that your children are cared for by someone you trust, in an environment that you approve of, thereby providing stability and continuity in their upbringing even in your absence.

Additionally, a Will enables you to select an executor who will manage your estate, carry out your wishes, and navigate the probate process. This role is crucial as it involves settling debts, distributing assets, and ensuring that your estate is handled efficiently and according to your directives. Choosing someone competent and trustworthy to fulfill this responsibility can simplify the administrative aspects of your estate, reduce the burden on your loved ones, and expedite the distribution of your assets, making the process as smooth and stress-free as possible for all involved.

Simplified Explanation of Legal Concepts

Understanding essential legal terms is key when you're putting together a Last Will and Testament, particularly in New Jersey. Here's a breakdown of these terms to help you grasp their meanings more easily:

Witnesses: These are individuals who observe you signing your Will and then sign it themselves to verify your signature. In New Jersey, your Will needs to be signed by at least two witnesses who are not beneficiaries in the Will to ensure its validity.

Intestacy Laws: If you pass away without a Will, New Jersey's intestacy laws come into play, dictating how your assets will be divided. Typically, these laws favor close family members, distributing your estate to your spouse, children, or other relatives in a defined order.

Guardianship: If you have minor children, you can use your Will to nominate a guardian who will look after them if something happens to you and the other parent. This ensures your children are cared for according to your wishes.

Notarization: Having a notary public authenticate the signing of your Will isn't required in New Jersey, but doing so can create a "self-proving" Will, which may expedite the probate process by negating the need for your witnesses to appear in court.

Beneficiaries: These are the individuals or organizations you choose to inherit your assets, such as family members, friends, or charities. Your Will should clearly specify who your beneficiaries are and what you'd like each to receive.

Estate Planning: This encompasses the overall strategy for managing and disposing of your estate after your death. While creating a Will is a fundamental aspect of estate planning, you might also consider other elements depending on your assets and personal wishes.

By clarifying these terms, you'll be better positioned to draft a Last Will and Testament in New Jersey that accurately reflects your desires and complies with state laws, ensuring a smoother estate planning process.

Key Requirements for a Valid Will in New Jersey

For a Will to be considered valid in New Jersey, it must meet specific legal requirements. Understanding these requirements is crucial to ensure that your final wishes are honored. Here are the key criteria:

Testator's Capacity: The person making the Will, known as the testator, must be at least 18 years old and of sound mind. This means the testator understands the nature of making a Will, knows the extent of their assets, and recognizes the natural beneficiaries of their estate.

Written Document: The Will must be in writing. While New Jersey law primarily recognizes traditional paper documents, there is growing legal discussion around digital Wills, but the safest approach is to stick with a written, physical document.

Testator's Signature: The testator must sign the Will at its end. If the testator is unable to sign due to a physical condition, another person can sign on their behalf in the testator's presence and under their direction.

Witnesses: The signing of the Will must be witnessed by at least two individuals, who must also sign the Will, attesting that they observed the testator's signing or acknowledgment of the signature. Witnesses should be "disinterested," meaning they do not stand to benefit from the Will, to avoid potential conflicts of interest.

Voluntary Act: The testator's signing of the Will must be a voluntary act, free from undue influence, coercion, or duress from others.

Clear Beneficiaries: The Will should clearly identify the beneficiaries and the specific assets or portions of the estate they are to receive. Clarity in this section helps prevent disputes and confusion during the probate process.

Executor Appointment: Although not strictly required for validity, the Will should appoint an executor who will manage the estate's administration according to the Will's directives. The executor handles tasks like paying off debts, managing assets, and distributing the estate to the named beneficiaries.

Meeting these requirements helps ensure that a Will in New Jersey is legally valid and can be successfully executed according to the testator's wishes during the probate process. It's often advisable to consult with a legal professional specializing in estate planning to ensure all legal criteria are met and the Will is structured effectively.

Is Notarization Required for Your New Jersey Last Will?

In New Jersey, notarization is not a mandatory requirement for a Last Will and Testament to be considered valid. The essential legal requirements for a Will's validity in the state include the testator's signature and the presence of at least two witnesses who observe the signing process and sign the document themselves. Notarization, which involves a notary public authenticating the signatures on the document, can add an extra layer of verification but is not necessary for the Will's legality. However, including a notarized "self-proving" affidavit with the Will can simplify the probate process by negating the need for witnesses to testify to the Will's authenticity in court, making it a practical consideration despite not being a legal necessity.

Types of Wills Recognized in New Jersey

New Jersey recognizes several types of Wills, accommodating various circumstances and preferences:

-

Standard Written Will: This is the most common type, traditionally typed and printed. It must be signed by the testator and witnessed by at least two individuals to be valid.

-

Holographic Will: This type of Will is handwritten by the testator. For it to be valid in New Jersey, the material provisions and the signature must be in the testator's handwriting. While a holographic Will doesn't need to be witnessed, proving its authenticity can be more challenging in probate court.

-

Nuncupative (Oral) Will: New Jersey law recognizes oral Wills under very limited circumstances, primarily for those in the military during active service or individuals experiencing their last illness. The statements must be witnessed by two individuals who must reduce the Will to writing within a specific period.

- Self-Proving Will: While technically not a separate type of Will, a self-proving Will includes a notarized affidavit from the witnesses, confirming their presence during the testator's signing. This affidavit can expedite the probate process by eliminating the need for witnesses to appear in court to validate the Will.

Understanding the types of Wills acknowledged in New Jersey can help individuals make informed decisions about how to best document their final wishes in a manner that suits their personal circumstances and legal requirements.

Is a Handwritten Last Will Valid in New Jersey?

In New Jersey, a handwritten Last Will, also known as a holographic Will, can be considered valid under certain conditions. For a holographic Will to be recognized by the courts, the material provisions, including the distribution of assets and the designation of beneficiaries, as well as the testator's signature, must be in the testator's handwriting. The Will does not necessarily need to be witnessed, given that the handwriting can be verified as belonging to the testator, often through comparison with other verified writings.

Despite its potential validity, the lack of formal witnessing and notarization can make the probate process more complex and contentious. It may be harder to prove the Will's authenticity and the testator's intent, especially if the Will is challenged. Therefore, while New Jersey law allows for holographic Wills, it's often recommended to have a Will professionally prepared and properly witnessed to ensure its clarity, legality, and the smooth execution of the testator's final wishes.

Sample of an New Jersey Last Will and Testament

Start planning your future with a New Jersey Last Will and Testament. This important paper helps decide who gets your things and follows your wishes after you're gone. Click below to see a sample Will and begin making sure everything's taken care of for you and your family.

Benefits of Having a Last Will and Testament

Having a Last Will and Testament offers several significant benefits:

Control Over Asset Distribution: It allows you to specify exactly how you want your assets to be distributed among your loved ones, charities, or others, ensuring your wishes are followed.

Protection for Beneficiaries: You can protect your beneficiaries, especially minors or those with special needs, by making clear provisions for their care and financial support.

Choice of Executor: You can choose an executor you trust to manage your estate, ensuring that someone competent and reliable is in charge of executing your wishes.

Guardianship Decisions: For parents of minor children, a Will is crucial for naming a guardian to take care of your children if something happens to you, giving you peace of mind regarding their well-being.

Minimize Family Disputes: A clear and legally binding Will can reduce potential conflicts among family members by clearly stating your intentions, helping to preserve family harmony.

Efficient Estate Settlement: Having a Will can streamline the probate process, potentially saving time, reducing legal fees, and minimizing complications in settling your estate.

Tax Planning: A well-structured Will can also include tax planning strategies to minimize the tax burden on your estate and beneficiaries.

Charitable Contributions: If you wish to leave a legacy by contributing to charities, a Will enables you to include such bequests clearly and precisely.

By creating a Last Will and Testament, you take a proactive step in managing your affairs, providing for your loved ones, and ensuring your final wishes are respected.

Consequences of Not Having a Last Will and Testament

-

State-Determined Distribution: Without a Will, your assets will be distributed according to your state's intestacy laws, which might not align with your personal wishes. This can lead to unintended beneficiaries receiving parts of your estate.

-

Complicated Probate Process: The absence of a Will often complicates the probate process, making it more time-consuming and potentially more costly for your estate and heirs.

-

Family Disputes: Without your clear directives, there's a higher risk of disputes among family members about asset distribution, which can lead to strained relationships and legal battles.

-

Guardianship Uncertainties: For parents, not having a Will means you haven't legally appointed a guardian for your minor children, leaving the decision to the courts, which may not choose the person you would have preferred.

-

Inefficiencies and Delays: The process of settling your estate without a Will can be significantly slower, delaying the time it takes for your beneficiaries to receive their inheritance.

-

Loss of Control: You lose the opportunity to shape your legacy, including making specific bequests, charitable donations, or setting up trusts that could benefit your loved ones or causes you care about.

-

Increased Legal Costs: The lack of a Will can lead to higher legal expenses as the court supervises more aspects of the estate distribution process.

- Potential for Unintended Beneficiaries: Without a Will, distant relatives or those with whom you might not have a close relationship could inherit parts of your estate, contrary to your wishes.

Requirements for Executors of Last Wills in New Jersey

In New Jersey, the role of an executor, the individual responsible for administering a deceased person's estate, comes with specific requirements and expectations. Here are the key criteria and considerations for executors in New Jersey:

Legal Age: The executor must be at least 18 years old, ensuring they are legally considered an adult capable of handling the responsibilities involved.

Mental Competency: Executors need to be of sound mind, meaning they must have the mental capacity to understand and fulfill their duties in managing the estate.

No Felony Convictions: Typically, New Jersey prefers executors without any felony convictions, especially those related to dishonesty, as the role requires a high level of trustworthiness.

Residency: While New Jersey does not strictly require the executor to be a resident of the state, appointing someone who lives out of state can pose practical challenges and may require them to appoint an in-state agent.

Willingness to Serve: The selected executor must be willing to take on the role. It involves significant responsibilities, including filing the Will with the probate court, inventorying the estate's assets, paying debts and taxes, and distributing assets to beneficiaries.

Bonding Requirement: In some cases, New Jersey may require the executor to post a bond, a form of insurance to protect the estate against potential mismanagement by the executor. The Will itself can waive this requirement.

Court Approval: Ultimately, the executor's appointment must be approved by the probate court in New Jersey, even if named in the Will. The court ensures the executor meets all legal requirements and is capable of performing the duties.

Choosing an executor who meets these requirements and is capable of managing the complexities of an estate is a crucial aspect of creating a Last Will and Testament in New Jersey. It's advisable to discuss the role with potential executors to ensure they understand and are prepared for the responsibilities involved.

Creating Your Last Will and Testament

Creating your Last Will and Testament is a critical step in planning for the future, especially in New Jersey, where specific state laws influence the process. Here's a guide to help you navigate creating a valid Will in New Jersey:

-

Understand the Basics: Familiarize yourself with what a Will can and cannot do. It can dictate the distribution of your assets, appoint guardians for minor children, and nominate an executor. However, certain assets like jointly held property or those with designated beneficiaries might not be covered by your Will.

-

Decide on Your Beneficiaries: Clearly identify who you want to inherit your assets. These can include family members, friends, charities, or other organizations. Being specific helps prevent misunderstandings and legal challenges.

-

Choose an Executor: Select a trusted individual to carry out the instructions in your Will. Ensure they meet New Jersey's requirements for executors and are willing to take on the responsibilities.

-

Appoint a Guardian for Minor Children: If you have minor children, it's crucial to appoint a guardian in your Will. Consider discussing this responsibility with potential guardians to ensure they're prepared to accept.

-

Inventory Your Assets: Make a comprehensive list of your assets, including real estate, bank accounts, investments, personal property, and any digital assets. This will help you decide how to distribute them.

-

Draft Your Will: You can write your Will yourself, use an online template, or seek professional legal assistance for more complex estates. Ensure it complies with New Jersey laws, including being in writing, signed by you, and witnessed by at least two individuals.

-

Sign and Witness the Will: New Jersey law requires you to sign your Will in the presence of two witnesses, who must also sign the document. While not required, having your Will notarized can create a "self-proving" Will, which can simplify the probate process.

-

Store Your Will Safely: Keep your original Will in a secure location, such as a fireproof safe or a safety deposit box. Inform your executor and a trusted loved one where it is stored.

- Review and Update as Necessary: Life changes, such as marriages, divorces, births, or significant changes in assets, can necessitate updates to your Will. Regularly review your Will and make any necessary revisions.

Creating a Last Will and Testament in New Jersey doesn't have to be a daunting task. By taking it step by step and possibly consulting with an estate planning attorney, you can ensure your wishes are clearly documented and legally enforceable, providing peace of mind for you and your loved ones.

Modifying or Canceling Your Last Will in New Jersey

In New Jersey, modifying or canceling (revoking) your Last Will and Testament is permissible and sometimes necessary due to life changes like marriage, divorce, the birth of a child, or a significant shift in assets or relationships. Here's how you can make these important changes:

Modifying Your Will:

To modify your existing Will, you can either add a "codicil" or create a new Will. A codicil is a supplementary document used to make minor adjustments, addenda, or deletions to your original Will. It must be executed with the same formalities as a Will in New Jersey, meaning it needs to be in writing, signed by you, and witnessed by at least two individuals.

Canceling Your Will:

To cancel or revoke your Will, you can take several actions:

-

Creating a New Will: The most straightforward way to revoke a previous Will is by making a new one that explicitly states it revokes all previous Wills and codicils. This new Will must also comply with New Jersey's legal requirements for Wills.

-

Physical Destruction: You or someone acting on your direct order can physically destroy your Will by tearing, burning, shredding, or otherwise rendering it unreadable, with the intent to revoke it.

- Changes in Circumstances: Certain life events, like marriage or divorce, can automatically affect portions of your Will under New Jersey law. For instance, a divorce might invalidate any provisions favoring your former spouse, but it's better not to rely on these automatic revocations and to explicitly update your Will instead.

Points to Consider:

-

Clarity and Intent: Ensure your intentions are clear in any modifications or revocations to avoid potential disputes or confusion during the probate process.

-

Consultation with an Attorney: Given the legal nuances involved in modifying or canceling a Will, consulting with an estate planning attorney can provide valuable guidance and ensure your Will accurately reflects your wishes and complies with New Jersey laws.

- Regular Reviews: Life changes can impact your estate planning needs. Regularly review your Will and consider if modifications are necessary to reflect your current wishes and circumstances.

By understanding the processes and legal requirements for modifying or canceling a Will in New Jersey, you can ensure your estate plan remains aligned with your current wishes, providing peace of mind for you and your loved ones.

Navigating Probate in New Jersey

Navigating probate in New Jersey involves a court-supervised process to authenticate a deceased person's Last Will and Testament, if available, and oversee the distribution of their estate. When a person passes away, their estate must go through probate unless their assets are structured to avoid it, such as through trusts or joint ownerships with rights of survivorship. The probate process starts with filing the deceased's Will with the New Jersey Surrogate's Court in the county of their residence at the time of death. If the Will is deemed valid, the court appoints an executor, typically named in the Will, to manage the estate's affairs.

The executor's responsibilities include inventorying the deceased's assets, paying outstanding debts and taxes, and distributing the remaining assets to the rightful heirs or beneficiaries as directed by the Will. If the deceased did not leave a Will, they are considered to have died "intestate," and New Jersey's intestacy laws will determine how their assets are distributed, generally favoring close relatives such as spouses and children.

The duration of the probate process can vary significantly, depending on the estate's complexity, the clarity of the Will, and whether there are any disputes among potential heirs or creditors. Throughout this period, the executor may need to make court appearances and file various documents with the court to demonstrate they are correctly managing and distributing the estate's assets. In cases where the estate is relatively small or consists primarily of personal property, New Jersey offers a simplified probate process, which can expedite the resolution of the estate.

Overall, while probate in New Jersey can be a complex and time-consuming process, it serves as a critical step in ensuring that a deceased person's assets are distributed according to their wishes or the law, providing a clear legal framework to settle their affairs.

Understanding Intestate Succession in New Jersey

Understanding intestate succession is crucial when a person passes away without a Last Will and Testament in New Jersey. In such cases, the state's intestacy laws dictate how the deceased's assets are distributed among surviving relatives. The primary objective of these laws is to allocate the estate in a manner that presumably aligns with the average person's wishes, prioritizing close family members.

In New Jersey, if the deceased is survived by a spouse and has no children or parents, the spouse inherits the entire estate. However, if there are surviving children, particularly from someone other than the surviving spouse, the distribution becomes more complex, with the spouse receiving the first 25% (but not less than $50,000 or more than $200,000) plus half of the remaining estate, and the children receiving the rest. The laws also cover scenarios where there are surviving parents but no spouse or children, with the estate going entirely to the parents.

For individuals without a surviving spouse, children, or parents, the estate is distributed to more distant relatives, such as siblings, nieces, and nephews, and can extend further to more remote kin under the state's succession hierarchy. In the rare event that no relatives can be located, the estate eventually escheats, or reverts, to the state.

Intestate succession can lead to outcomes that might not reflect the deceased's personal relationships or wishes, underscoring the importance of having a well-drafted Will. It provides a clear directive for the distribution of one's assets, potentially avoiding the default allocations set by intestacy laws and ensuring that one's estate is distributed according to their specific desires.

Understanding Estate and Inheritance Taxes in New Jersey

In New Jersey, understanding estate and inheritance taxes is important for estate planning and the distribution of assets after death. New Jersey has distinct rules regarding these taxes, which can impact how much beneficiaries receive from an estate. The estate tax, which was repealed in 2018, was levied on the overall value of the deceased's estate before distribution to any beneficiaries. This tax no longer applies, simplifying estate settlements in New Jersey.

However, New Jersey still imposes an inheritance tax, which is relatively unique as not all states have this. The inheritance tax is not based on the size of the estate but on the relationship between the deceased and the beneficiary. Immediate family members, such as spouses, children, grandchildren, and parents, are generally exempt from this tax. More distant relatives and non-relatives might be subject to the tax at varying rates, depending on the amount inherited and their relationship to the deceased.

FAQs About New Jersey Last Will and Testaments

Here are some frequently asked questions (FAQs) about Last Will and Testaments in New Jersey:

1. Do I need a lawyer to create a Will in New Jersey?

While you're not legally required to have a lawyer to create a Will in New Jersey, consulting with an estate planning attorney can ensure that your Will complies with state laws and fully captures your intentions, especially for complex estates.

2. Can I write my own Will by hand in New Jersey?

Yes, New Jersey recognizes handwritten (holographic) Wills, provided they are written, dated, and signed entirely in your handwriting. However, proving their validity in court can be more challenging without witness signatures.

3. What happens if I die without a Will in New Jersey?

If you pass away without a Will, you're considered to have died "intestate," and your estate will be distributed according to New Jersey's intestacy laws, which might not align with your personal wishes.

4. Can I disinherit a family member in New Jersey?

Yes, you can disinherit individuals except for your spouse, who may still claim an elective share of your estate under New Jersey law, unless they have waived this right, typically through a prenuptial or postnuptial agreement.

5. How often should I update my Will?

It's wise to review and potentially update your Will after major life events, such as marriage, divorce, the birth of a child, significant changes in assets, or changes in the law that might affect your estate planning.

6. Does a Will avoid probate in New Jersey?

No, having a Will does not avoid probate. However, it can simplify the probate process by clearly outlining how you wish your estate to be distributed.

7. Are digital assets included in Wills?

Yes, digital assets can and should be included in your Will. It's important to provide instructions and necessary access information for handling your digital assets, such as social media accounts, digital wallets, and online properties.

8. Can I change my Will?

Absolutely. You can update your Will anytime as long as you're mentally competent. This can be done through a new Will or a codicil, which is an amendment to your existing Will.

9. What is a "self-proving" Will?

A "self-proving" Will includes a notarized affidavit from the witnesses, confirming their presence at the signing and the authenticity of the Will. This can expedite the probate process in New Jersey.

10. Does a Will cover all my assets?

Some assets, such as those with designated beneficiaries (like life insurance policies or retirement accounts) and jointly owned assets with rights of survivorship, are typically not covered by a Will and pass outside of probate.

Testimonial from Matthew Elder

“Everyone knows that having a will is essential, particularly when you have accumulated assets that would need to be transferred to rightful heirs after death. In today’s digital age, however, your assets also include the virtual – everything in cyberspace that can be considered your personal property, such as online accounts with financial institutions, governments, telecommunications services, travel booking tools. This cyber list also includes social-media accounts. The list may be very long.

Conclusion

In summary, making a Last Will and Testament in New Jersey is a key step to make sure your wishes are followed and your family is taken care of when you're gone. By setting aside some time to clearly outline what you want, you can reduce confusion, avoid arguments within the family, and make sure your belongings go to the right people. You can either get help from a lawyer or try to do it yourself, but either way, having a Will that legally counts is very comforting.

It's also really important to look over your Will now and then and make updates if things in your life or finances change. By keeping on top of it and making sure your Will is up-to-date, you can handle whatever life throws your way and keep your estate plans on track. All in all, putting in the work to make a detailed Will is a smart move that brings peace of mind to you and your loved ones for the future.

Download Your New Jersey Last Will and Testament

Want to make sure your final wishes are clear and legally written down? Get started with our New Jersey Last Will and Testament today. It's easy to use and you can make it fit your needs, deciding who gets what, and who looks after things if needed. Don't leave things up in the air – make a Will that says exactly what you want for the future. This way, you and your family can feel more secure. Download it now and take the first step towards sorting out your estate.

Author's Expertise

Ivon T. Hughes designed Digital Wealth Media to greatly simplify the process so that more people can enjoy the peace of mind and wealth-building power of asset protection.

To further educate and help people, there is a treasure trove of asset protection articles and videos on the Digital Wealth Media website, along with a variety of wealth-protection packages that include Wills and other legal documents, including Digital Wills, which are something that just became necessary recently due to the continued expansion of the Internet.

Legal References and Sources

If you're looking for more details or confirmation about estate planning in New Jersey, the following legal resources and official government websites offer thorough insights into the state laws and processes involved in estate planning:

New Jersey Statutes: You can find the laws related to estate planning, Wills, and probate procedures in New Jersey by exploring the New Jersey Statutes, particularly the sections devoted to Wills, estates, and probate matters.

New Jersey Judiciary: The official site of the New Jersey Judiciary provides information and resources regarding probate court proceedings, estate administration, and related legal topics. It also includes access to necessary court forms and guidance on preparing a Last Will and Testament.

New Jersey State Bar Association: The website for the New Jersey State Bar Association contains valuable information on estate planning, featuring articles, FAQs, and resources to help you find experienced attorneys who specialize in estate planning and probate law in New Jersey.

New Jersey Division of Taxation: For insights regarding estate taxes and other tax considerations important to estate planning in New Jersey, the Division of Taxation's website is a go-to source.

Legal Services of New Jersey: Legal aid organizations like Legal Services of New Jersey provide support and resources for individuals who need legal advice on estate planning matters but may have limited financial resources.

These resources offer crucial information for anyone looking to navigate the complexities of estate planning and creating a Last Will and Testament in New Jersey. While these authoritative sources are a great starting point, it's often wise to seek personalized legal advice to address your specific estate planning needs.

Legal Disclaimer

The content offered on this webpage is designed for informational and educational purposes only, and should not be taken as legal counsel specific to New Jersey laws or any other jurisdiction.

Estate planning, probate, and wills are governed by state-specific regulations that can change over time. The information provided here may not represent the most recent legal developments or guidelines relevant to New Jersey.

It is highly recommended that individuals consult with a licensed attorney or legal expert in New Jersey to obtain advice that is tailored to their personal estate planning requirements. Engaging with a legal professional acquainted with New Jersey's statutes will ensure that individuals get precise and customized guidance.

No attorney-client relationship is formed by accessing or utilizing the information on this webpage. The creators, publishers, and disseminators of this content renounce any liability for any reliance on the information contained herein or for any loss or harm incurred from its application.

Before making any estate planning decisions, including drafting a Last Will and Testament in New Jersey, thorough investigation and professional legal consultation are crucial to ensure informed and lawful choices.