Pennsylvania Last Will and Testament

State of Pennsylvania

State of Pennsylvania

Overview:

- Create Your Pennsylvania Last Will and Testament

- Understanding the Importance of a Last Will and Testament

- Simplified Explanation of Legal Concepts

- Key Requirements for a Valid Will in Pennsylvania

- Is Notarization Required for Your Pennsylvania Last Will?

- Types of Wills Recognized in Pennsylvania

- Is a Handwritten Last Will Valid in Pennsylvania?

- Sample of an Pennsylvania Last Will and Testament

- Benefits of Having a Last Will and Testament

- Consequences of Not Having a Last Will and Testament

- Requirements for Executors of Last Wills in Pennsylvania

- Creating Your Last Will and Testament

- Modifying or Canceling Your Last Will in Pennsylvania

- Navigating Probate in Pennsylvania

- Understanding Intestate Succession in Pennsylvania

- Understanding Estate and Inheritance Taxes in Pennsylvania

- FAQs About Pennsylvania Last Will and Testaments

- Testimonials

- Conclusion

- Download Your Pennsylvania Last Will and Testament

- Author's Expertise

- Legal References and Sources

- Legal Disclaimer

Create Your Pennsylvania Last Will and Testament

Crafting your Pennsylvania Last Will and Testament is a crucial step towards securing your legacy and ensuring your final wishes are honored. By creating a personalized Will, you can designate how your assets will be distributed among your loved ones, appoint guardians for minor children, and specify any other instructions or preferences you may have. Whether you're outlining your preferences for healthcare decisions or designating beneficiaries for specific assets, a carefully drafted Will provides clarity and peace of mind for you and your family.

Pennsylvania state laws govern the creation and execution of Wills, outlining specific requirements and procedures to ensure their validity. By consulting with a qualified attorney familiar with Pennsylvania estate planning laws, you can navigate the process effectively and ensure that your Will complies with all legal requirements. With a comprehensive Last Will and Testament in place, you can have confidence that your wishes will be respected and your loved ones will be provided for according to your intentions.

Understanding the Importance of a Last Will and Testament

A Last Will and Testament is a critical legal document that allows individuals to dictate how their assets and property will be distributed upon their death. In essence, it serves as a blueprint for the distribution of one's estate, ensuring that their wishes are carried out and their loved ones are provided for according to their desires. By clearly outlining who will inherit specific assets, such as real estate, financial accounts, or personal belongings, a Will helps prevent disputes among family members and ensures a smoother transition of assets.

Furthermore, a Last Will and Testament enables individuals to appoint guardians for minor children, designate executors to oversee the administration of their estate, and make provisions for any outstanding debts or liabilities. Without a valid Will in place, state laws, known as intestacy laws, will determine how the estate is distributed, which may not align with the individual's preferences. Thus, creating a Will allows individuals to maintain control over their assets and estate, providing peace of mind knowing that their wishes will be carried out and their loved ones will be provided for after their passing.

Simplified Explanation of Legal Concepts

Crafting a Last Will and Testament in Pennsylvania is a crucial step in securing one's legacy and ensuring that their final wishes are upheld. To navigate this process effectively, it's essential to understand key legal concepts related to will creation in the state. By demystifying these terms, individuals can approach estate planning with confidence and clarity, empowering them to make informed decisions about their assets and beneficiaries.

-

Testator: The individual crafting the Will, who must be at least 18 years old and of sound mind in Pennsylvania.

-

Witnesses: Individuals who observe the testator sign the Will and validate its authenticity. Pennsylvania typically requires at least two witnesses, who must be of legal age and not beneficiaries.

-

Intestacy Laws: In the absence of a valid Will, Pennsylvania intestacy laws govern the distribution of an individual's estate, prioritizing spouses, children, and other close relatives according to a predetermined hierarchy.

-

Guardianship: Designating a guardian for minor children in the event of both parents' deaths. Through a Will, the testator can nominate a trusted individual to ensure the welfare and upbringing of their children aligns with their wishes.

-

Notarization: The process of having the Will's execution verified by a notary public, confirming the identities of the signatories and adding an extra layer of authenticity to the document.

-

Beneficiaries: The individuals or entities named in the Will to receive the testator's assets, which may include family members, friends, or charitable organizations chosen by the testator.

- Estate Planning: Strategically organizing the management and distribution of one's assets after death. Drafting a Will is a fundamental aspect of estate planning in Pennsylvania, ensuring that the testator's wishes are carried out effectively.

Understanding these essential legal terms can simplify the process of creating a Last Will and Testament in Pennsylvania, allowing individuals to make informed decisions and ensure their final wishes are accurately documented and legally upheld. By familiarizing themselves with these concepts, individuals can navigate the complexities of estate planning with confidence, providing peace of mind for themselves and security for their loved ones.

Key Requirements for a Valid Will in Pennsylvania

Crafting a valid Last Will and Testament in Pennsylvania requires adherence to specific legal requirements to ensure its legitimacy and enforceability. Understanding these key requirements is essential for individuals seeking to create a legally binding Will in the state.

-

Capacity: One fundamental requirement for a valid Will in Pennsylvania is that the testator, the person creating the Will, must possess the mental capacity to understand the nature of the document and the consequences of its provisions. This means the testator must be of sound mind and at least 18 years old to execute a Will.

-

Signature: Pennsylvania law mandates that the Will must be signed by the testator or by another person in the testator's conscious presence and at their direction. Additionally, the testator's signature must be affixed to the Will at the end of the document or acknowledged by the testator as their own.

-

Witnesses: Pennsylvania requires the presence of at least two competent witnesses who witness the testator's signing of the Will. These witnesses must also sign the Will in the presence of the testator and each other to attest to its authenticity. Importantly, witnesses should not be beneficiaries of the Will to avoid potential conflicts of interest.

-

Formalities: While Pennsylvania does not mandate that Wills must be notarized to be valid, executing a "self-proving affidavit" in front of a notary public can simplify the probate process. This affidavit, signed by the testator and witnesses, attests to the Will's validity without the need for further witness testimony during probate.

- Revocation: To ensure the validity of a new Will, it's crucial to properly revoke any prior Wills. Pennsylvania law allows for the revocation of a Will through intentional destruction, cancellation, or by executing a new Will that explicitly revokes all previous Wills.

These key requirements outline the necessary elements for a valid Last Will and Testament in Pennsylvania, providing individuals with guidelines to create a legally enforceable document that accurately reflects their final wishes. Understanding and adhering to these requirements is essential for ensuring the validity and effectiveness of the Will in distributing assets and providing for loved ones according to the testator's intentions.

Is Notarization Required for Your Pennsylvania Last Will?

In Pennsylvania, notarization is not explicitly required for the validity of a Last Will and Testament. However, utilizing a notary public to execute a "self-proving affidavit" alongside the Will can streamline the probate process. This affidavit, signed by the testator and witnesses in front of a notary public, serves as a sworn statement affirming the authenticity of the Will without the need for further witness testimony during probate proceedings. While notarization is not mandatory, it can provide an additional layer of assurance regarding the validity of the Will and expedite the probate process for the testator's beneficiaries.

However, it's essential to note that while notarization can simplify the probate process, it does not inherently make the Will more valid or enforceable. The primary requirements for a valid Last Will and Testament in Pennsylvania are the testator's signature, witness signatures, and compliance with state laws regarding capacity, formalities, and revocation. Ultimately, whether to utilize notarization in conjunction with a Will is a personal decision based on individual preferences and circumstances. While it can offer advantages, such as added evidentiary value and reduced probate complications, the absence of notarization does not invalidate a properly executed Will in Pennsylvania.

Types of Wills Recognized in Pennsylvania

In Pennsylvania, several types of Wills are recognized, each serving different purposes and meeting specific legal requirements:

-

Testamentary Wills: Testamentary Wills are the most common type of Will and are typically drafted by individuals to dictate how their assets should be distributed upon their death. To be valid, a Testamentary Will must meet Pennsylvania's statutory requirements, including the testator's signature and the signatures of at least two witnesses.

-

Holographic Wills: Holographic Wills are handwritten Wills that do not require witness signatures to be valid in Pennsylvania. However, they must be entirely handwritten and signed by the testator. While holographic Wills are recognized in Pennsylvania, they are subject to strict interpretation by the courts, and their validity may be challenged more easily.

-

Nuncupative Wills: Nuncupative Wills, also known as oral or deathbed Wills, are verbal declarations of a person's wishes regarding the distribution of their assets made before witnesses. In Pennsylvania, nuncupative Wills are generally not recognized as valid, except in limited circumstances involving members of the military or mariners at sea.

-

Joint Wills: Joint Wills are Wills created by two or more individuals, typically spouses, to dispose of their combined assets. While Joint Wills are permitted in Pennsylvania, they may present challenges during probate, particularly if one of the testators dies before the other.

- Living Wills: Living Wills, also known as Advance Directives, are legal documents that express a person's preferences regarding medical treatment in the event they become incapacitated and unable to communicate their wishes. While not traditional Wills for asset distribution, Living Wills are an essential component of comprehensive estate planning in Pennsylvania.

Understanding the different types of Wills recognized in Pennsylvania allows individuals to choose the most appropriate option based on their circumstances and preferences. Whether opting for a Testamentary Will, a Holographic Will, or another type of Will, it is crucial to ensure compliance with Pennsylvania's legal requirements to validate the document and safeguard one's final wishes.

Is a Handwritten Last Will Valid in Pennsylvania?

In Pennsylvania, handwritten (holographic) wills are generally valid if they meet certain requirements. The key factors for a handwritten will to be valid in Pennsylvania include:

-

Handwritten by the Testator: The will must be entirely handwritten by the person making the will (the testator). It cannot be typed or printed.

-

Signature of the Testator: The will must be signed by the testator.

-

Date: While not always required, it's advisable to include the date when the will was written to establish its timeliness and validity.

- Intent: The content of the will should clearly reflect the testator's intent to distribute their property and assets after their death.

However, it's important to note that Pennsylvania law does not require witnesses for a handwritten will to be valid. Nevertheless, it's generally advisable to have witnesses to avoid potential challenges to the will's authenticity or validity.

Despite the validity of handwritten wills in Pennsylvania, it's often recommended to consult with an attorney to ensure that the will complies with all legal requirements and to address any specific concerns or complexities related to estate planning. An attorney can also provide guidance on drafting a comprehensive will that accurately reflects the testator's wishes and minimizes the potential for disputes among beneficiaries.

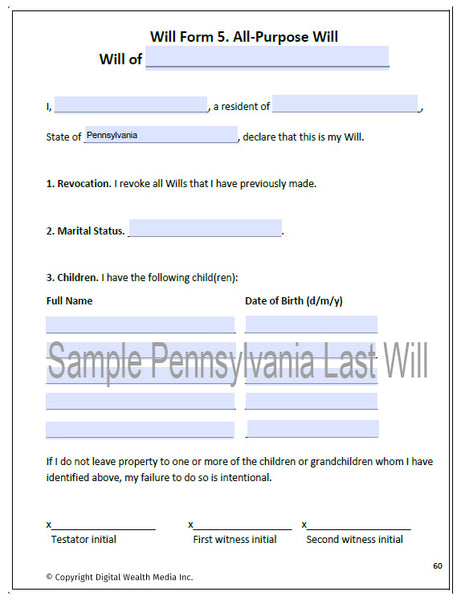

Sample of an Pennsylvania Last Will and Testament

Prepare for the future and ensure peace of mind with a Pennsylvania Last Will and Testament. This essential legal document enables you to outline how your assets will be distributed and ensures that your final wishes are honored. Access a sample Will tailored to Pennsylvania law below, taking the first step towards securing your legacy and providing clarity for your loved ones.

Benefits of Having a Last Will and Testament

Having a Last Will and Testament offers several key benefits:

-

Asset Distribution: A Will allows you to specify how you want your assets to be distributed after your passing. This ensures that your belongings go to the individuals or organizations you choose.

-

Guardianship of Minor Children: If you have minor children, a Will allows you to designate a guardian to care for them in the event of your death. This provides peace of mind knowing that your children will be taken care of by someone you trust.

-

Executor Appointment: You can name an executor in your Will, who will be responsible for carrying out your wishes as outlined in the document. This simplifies the probate process and ensures that your estate is handled according to your instructions.

-

Avoiding Intestacy Laws: Without a Will, your estate will be distributed according to the intestacy laws of your state, which may not align with your wishes. Having a Will allows you to maintain control over the distribution of your assets.

-

Minimizing Family Disputes: A clear and legally binding Will can help minimize disputes among family members regarding the distribution of your estate. By clearly outlining your intentions, you reduce the likelihood of disagreements and potential legal battles.

- Protecting Unmarried Partners: For unmarried couples, a Will is essential for ensuring that your partner receives assets and benefits after your death. Without a Will, unmarried partners may not be entitled to any inheritance under intestacy laws.

Expressing Funeral Wishes: Your Will can include instructions regarding your funeral arrangements and final wishes. This ensures that your preferences regarding burial or cremation, funeral service, and other arrangements are known and respected.

Overall, having a Last Will and Testament provides peace of mind, ensures your wishes are carried out, and helps protect your loved ones during a difficult time.

Consequences of Not Having a Last Will and Testament

- Intestate Succession: Without a Will, your estate will be distributed according to the intestate succession laws of your state. This means that your assets will be divided among your heirs based on predetermined rules, which may not align with your wishes.

- Lack of Control: Intestacy laws determine how your assets are distributed, regardless of your preferences. This can result in your assets going to family members whom you may not have chosen as beneficiaries.

- Lengthy Probate Process: The probate process can be more complicated and time-consuming without a Will. The court will appoint an administrator to handle your estate, which may cause delays in distributing assets to your heirs.

- Potential Family Disputes: Intestacy can lead to disagreements among family members regarding asset distribution. Without clear instructions in a Will, disputes may arise, leading to strained relationships and potential legal battles.

- No Guardian Designation: If you have minor children, a Will allows you to designate a guardian to care for them in the event of your death. Without a Will, the court will decide who will assume guardianship, which may not align with your wishes.

- Unintended Tax Consequences: Without proper estate planning, your heirs may face higher tax liabilities. A Will can include provisions to minimize estate taxes and ensure that your assets are distributed tax-efficiently.

- Risk to Unmarried Partners: Unmarried partners may not be entitled to any inheritance under intestacy laws. Without a Will, your partner may not receive any assets or benefits from your estate, leaving them financially vulnerable.

Requirements for Executors of Last Wills in Pennsylvania

In Pennsylvania, the executor of a Last Will and Testament, often referred to as a personal representative, must meet certain requirements to fulfill their duties effectively. Here are the key requirements for executors of Last Wills in Pennsylvania:

-

Legal Capacity: The executor must be legally competent and of sound mind. This means they must be at least 18 years old and mentally capable of handling the responsibilities of the role.

-

Residency: While Pennsylvania law does not explicitly require the executor to be a resident of the state, it is generally advisable to appoint someone who resides within Pennsylvania or is familiar with its legal processes.

-

No Felony Convictions: Pennsylvania law prohibits individuals convicted of certain felony offenses from serving as executors. Anyone convicted of a serious crime may be disqualified from serving as an executor.

-

Understanding of Responsibilities: The executor should have a clear understanding of their duties and responsibilities under Pennsylvania law. These duties include gathering and managing the decedent's assets, paying debts and taxes, and distributing assets to beneficiaries according to the terms of the Will.

-

Trustworthiness and Integrity: Executors are entrusted with managing the decedent's estate and carrying out their final wishes. Therefore, they must be honest, reliable, and capable of acting in the best interests of the estate and its beneficiaries.

-

Ability to Communicate and Organize: Effective communication and organizational skills are essential for executors. They must be able to interact with beneficiaries, creditors, and other parties involved in the probate process, as well as keep accurate records of estate transactions.

- Willingness to Serve: Finally, the executor must be willing to accept the responsibilities of the role. Serving as an executor can be time-consuming and challenging, so it's important for the individual to be prepared to fulfill their duties diligently.

It's crucial to choose an executor who meets these requirements and is capable of handling the responsibilities associated with administering an estate. Additionally, consulting with an experienced estate planning attorney in Pennsylvania can provide valuable guidance in selecting and appointing an executor.

Creating Your Last Will and Testament

Creating your Last Will and Testament is a crucial step in ensuring your final wishes are carried out and your loved ones are provided for after your passing. Here are the key steps to help you create your Will:

-

Gather Information: Compile a list of your assets, including real estate, bank accounts, investments, vehicles, and personal belongings. Also, make a list of your beneficiaries, including family members, friends, and charitable organizations you wish to include in your Will.

-

Choose an Executor: Select a trustworthy individual to serve as the executor of your Will. This person will be responsible for carrying out your instructions, managing your estate, and ensuring your wishes are fulfilled.

-

Decide on Distribution: Determine how you want your assets to be distributed among your beneficiaries. You can specify specific gifts, such as heirlooms or cash amounts, and allocate the remainder of your estate according to percentages or specific instructions.

-

Consider Guardianship: If you have minor children, decide who will serve as their guardian in the event of your passing. This is especially important if the other parent is unavailable or if you're a single parent.

-

Draft Your Will: Write your Will using clear and precise language. You can use online templates, software, or seek assistance from an attorney specializing in estate planning to ensure your Will complies with state laws and addresses your unique circumstances.

-

Witnesses and Signatures: In Pennsylvania, your Will must be signed by you (the testator) and witnessed by two competent individuals who are not beneficiaries named in the Will. Their signatures validate the document and attest to your capacity and intention.

-

Keep Your Will Safe: Store your original Will in a secure location, such as a safe deposit box or with your attorney. Inform your executor of its whereabouts and provide copies to trusted individuals.

-

Review and Update Regularly: Review your Will periodically to ensure it reflects your current wishes and circumstances. Life events such as marriage, divorce, births, deaths, or significant changes in your assets may necessitate updates to your Will.

- Consider Legal Advice: While it's possible to create a Will without legal assistance, consulting with an estate planning attorney can provide valuable guidance, especially for complex estates or situations involving blended families, business ownership, or tax considerations.

By following these steps and seeking appropriate guidance, you can create a comprehensive Last Will and Testament that reflects your wishes and provides clarity and security for your loved ones.

Modifying or Canceling Your Last Will in Pennsylvania

In Pennsylvania, you have the legal right to modify or cancel your Last Will and Testament at any time as long as you are of sound mind and meet the legal requirements. Here's how you can modify or cancel your Will:

-

Create a Codicil: If you wish to make minor changes to your existing Will, you can create a codicil. A codicil is a legal document that amends specific provisions of your Will without revoking the entire document. It must be executed with the same formalities as a Will, including signatures from witnesses.

-

Execute a New Will: Alternatively, you can revoke your existing Will by creating and executing a new one. A new Will should explicitly state that it revokes all previous Wills and codicils. Ensure that the new Will addresses all necessary updates and reflects your current wishes regarding asset distribution and beneficiaries.

-

Destroy the Original Will: If you intend to revoke your Will without creating a new one, you can destroy the original document. Common methods of revocation include tearing, shredding, or burning the Will with the intent to revoke its validity. It's essential to destroy all copies of the Will to prevent any confusion or disputes.

-

Express Revocation: You can also expressly revoke your Will by making a declaration to that effect in writing. This written declaration should clearly state your intention to revoke the Will and be signed and dated. While not legally required, it can provide additional clarity and evidence of your intent.

- Seek Legal Advice: Revoking or modifying a Will can have significant legal implications, so it's advisable to seek guidance from an experienced estate planning attorney. They can ensure that your actions comply with Pennsylvania laws and help you navigate any complexities or challenges that may arise.

Regardless of the method you choose to modify or cancel your Last Will and Testament, it's crucial to inform your executor and trusted individuals of your intentions. Keeping clear records of your actions and communicating changes effectively can help prevent confusion and ensure that your wishes are carried out as intended.

Navigating Probate in Pennsylvania

Navigating probate in Pennsylvania involves several key steps. Firstly, the deceased person's Last Will and Testament must be filed with the Register of Wills in the county where they resided. If there is no Will, intestate succession laws come into play.

Next, an executor is appointed to administer the estate. If no executor is named or willing to serve, the court appoints an administrator. The appointed individual is responsible for managing the estate, which includes gathering assets, paying debts, and distributing property to beneficiaries.

The executor or administrator must notify known creditors of the estate and publish a notice to creditors in a local newspaper. Creditors have a limited time to file claims against the estate.

An inventory of the deceased person's assets, such as real estate, bank accounts, investments, and personal property, must be compiled. Assets may need to be appraised to determine their value.

Payment of outstanding debts, including taxes, funeral expenses, and creditors' claims, is the responsibility of the executor or administrator. This may require selling assets to cover expenses.

Once debts and taxes are settled, remaining assets are distributed to beneficiaries according to the terms of the Will or intestate succession laws. Court approval may be necessary for the distribution.

After settling all debts and distributing assets, the executor or administrator prepares a final accounting of the estate's administration. This accounting is submitted to the court for approval. Once approved, the estate can be closed, and the executor or administrator discharged of their duties.

Probate can be complex and time-consuming, especially for those unfamiliar with legal procedures. Executors or administrators may seek guidance from a probate attorney to ensure compliance with state laws and efficient estate administration.

Understanding Intestate Succession in Pennsylvania

Intestate succession in Pennsylvania governs the distribution of a deceased person's assets when they die without a valid Last Will and Testament. In such cases, state law determines how the estate will be distributed among surviving family members.

The distribution of assets under intestate succession laws typically prioritizes close family members. In Pennsylvania, if the deceased is survived by a spouse but no children or parents, the spouse inherits the entire estate. If the deceased is survived by a spouse and children, the spouse may inherit a portion of the estate, with the remainder divided among the children.

If there is no surviving spouse, the estate passes to the deceased person's children. If there are no surviving children, the estate may pass to the deceased person's parents or, if they are deceased, to their siblings or their descendants.

In cases where no eligible family members can be found, the estate may escheat, meaning it goes to the state of Pennsylvania. However, escheat is rare and occurs only when no heirs can be located.

Understanding intestate succession laws is crucial for individuals who have not created a Will, as it determines how their assets will be distributed after their death. However, creating a valid Will allows individuals to have more control over the distribution of their estate and ensures that their wishes are followed.

Understanding Estate and Inheritance Taxes in Pennsylvania

Estate and inheritance taxes in Pennsylvania are important considerations for individuals managing their assets and planning for the future. Estate taxes are levied on the total value of a deceased person's estate before distribution to heirs, while inheritance taxes are imposed on the assets inherited by individual beneficiaries.

In Pennsylvania, estate taxes are only applicable to estates with a total value exceeding a certain threshold, known as the exemption limit. As of 2022, estates valued at less than $12.99 million are exempt from state estate taxes. Estates exceeding this threshold are subject to Pennsylvania estate taxes, which are calculated based on the estate's total value and range from 0.8% to 16%.

In contrast, inheritance taxes in Pennsylvania apply to the beneficiaries who receive assets from a deceased person's estate. The tax rate varies depending on the relationship between the deceased and the beneficiary. Spouses, parents, and children are typically exempt from inheritance taxes, while other beneficiaries may face tax rates ranging from 4.5% to 15%.

Understanding these taxes is essential for estate planning and ensuring that beneficiaries are aware of potential tax liabilities. Proper estate planning strategies, such as establishing trusts or gifting assets during one's lifetime, can help minimize tax burdens for both the estate and its beneficiaries. Seeking guidance from legal and financial professionals familiar with Pennsylvania tax laws can provide valuable assistance in navigating these complex matters.

FAQs About Pennsylvania Last Will and Testaments

Here are some frequently asked questions (FAQs) about Last Wills and Testaments in Pennsylvania:

1. What is a Last Will and Testament?

A Last Will and Testament is a legal document that outlines an individual's wishes regarding the distribution of their assets and the care of any dependents after their death.

2. Do I need a Last Will and Testament in Pennsylvania?

While Pennsylvania law doesn't require individuals to have a Will, having one can provide clarity and ensure your wishes are carried out according to your preferences.

3. Who can create a Last Will and Testament in Pennsylvania?

In Pennsylvania, any person of sound mind who is at least 18 years old or an emancipated minor can create a valid Will.

4. Can I create my Last Will and Testament without a lawyer in Pennsylvania?

Yes, individuals can create their Wills without a lawyer's assistance, but it's advisable to seek legal guidance, especially for complex estates or specific situations.

5. How do I revoke or amend my Last Will and Testament in Pennsylvania?

A Will can be revoked or amended in Pennsylvania by creating a new Will that explicitly revokes the previous one or by executing a codicil, which is a document used to modify specific provisions of an existing Will.

6. What happens if I die without a Will in Pennsylvania?

If a person dies without a Will in Pennsylvania, their estate will be distributed according to intestate succession laws, which outline the default distribution of assets among legal heirs.

7. How do I ensure my Last Will and Testament is valid in Pennsylvania?

To ensure validity, a Pennsylvania Will must be in writing, signed by the testator (person making the Will), and witnessed by at least two individuals who are not beneficiaries or spouses of beneficiaries.

8. Can I include funeral and burial instructions in my Last Will and Testament in Pennsylvania?

Yes, individuals can include funeral and burial instructions in their Wills, but it's essential to communicate these wishes to loved ones and ensure they have access to the document when needed.

9. Where should I keep my Last Will and Testament in Pennsylvania?

It's recommended to keep the original copy of your Will in a safe and secure location, such as a fireproof safe or with your attorney. You should also inform trusted individuals, such as your executor or family members, of its whereabouts.

10. Can I update my Last Will and Testament in Pennsylvania?

Yes, individuals can update their Wills as needed to reflect changes in circumstances, such as births, deaths, marriages, or changes in assets. It's essential to review and update your Will periodically to ensure it remains accurate and reflects your current wishes.

Testimonials

Here are some testimonials from individuals who have successfully utilized the guidance provided in this article to create their Will:

Testimonial from Ronald W.

“I have looked into "THE DIGITAL WILL" and am impressed with the necessity of it. For myself, it will allow my heirs to have access to my personal financial accounts. As well, my executor will now have access to my client data, which would be important for the benefit of my clients to have the backup they might need.”

Testimonial from Anthony Mack

"I am glad to see that someone has finally developed a Digital Will to help us get all of this information together. It will help ease the difficulty when we are no longer here. The whole digital thing is affecting us more and more, though I never gave much thought until a recent death"

Conclusion

In conclusion, having a Last Will and Testament in Pennsylvania is a crucial step in ensuring that your assets are distributed according to your wishes and that your loved ones are provided for after your passing. While the process of creating and managing a Will may seem daunting, it offers peace of mind and clarity for both you and your family. By understanding the legal requirements, seeking guidance when needed, and keeping your Will updated, you can navigate the estate planning process with confidence. Whether you choose to create your Will independently or with the assistance of legal professionals, the effort invested in planning for the future can alleviate stress and uncertainty for your loved ones during an already challenging time.

Download Your Pennsylvania Last Will and Testament

To download your Pennsylvania Last Will and Testament, please click the link below:

Download Pennsylvania Last Will and Testament

This document is tailored to Pennsylvania law and will help you dictate the distribution of your assets and ensure your final wishes are respected.

Author's Expertise

Ivon T. Hughes designed Digital Wealth Media to greatly simplify the process so that more people can enjoy the peace of mind and wealth-building power of asset protection.

To further educate and help people, there is a treasure trove of asset protection articles and videos on the Digital Wealth Media website, along with a variety of wealth-protection packages that include Wills and other legal documents, including Digital Wills, which are something that just became necessary recently due to the continued expansion of the Internet.

Legal References and Sources

For those seeking additional information or validation regarding estate planning in Pennsylvania, the following legal references and official government sources provide comprehensive insights into Pennsylvania state laws and procedures related to estate planning:

Pennsylvania Consolidated Statutes: The official website of the Pennsylvania General Assembly offers access to the Pennsylvania Consolidated Statutes, which encompass laws governing estate planning, Wills, and probate procedures in Pennsylvania.

Pennsylvania Probate Courts: The Pennsylvania Courts website provides resources and information on probate proceedings, estate administration, and related legal matters. It also offers access to court forms and instructions for creating a Last Will and Testament.

Pennsylvania Bar Association: The Pennsylvania Bar Association website offers guidance on estate planning, including articles, FAQs, and resources for finding qualified attorneys specializing in estate planning and probate law in Pennsylvania.

Pennsylvania Department of Revenue: For information regarding estate taxes and other tax-related considerations relevant to estate planning in Pennsylvania, the Pennsylvania Department of Revenue website serves as an authoritative source.

Legal Aid Organizations: Legal aid organizations such as Pennsylvania Legal Aid Network and Philadelphia Legal Assistance offer assistance and resources for low-income individuals seeking legal guidance on estate planning matters in Pennsylvania.

These legal references and sources serve as valuable resources for individuals seeking to understand and comply with Pennsylvania state laws governing estate planning and Last Will and Testament creation. It is advisable to consult these authoritative sources or seek professional legal advice for personalized guidance on specific estate planning issues in Pennsylvania.

Legal Disclaimer

It is important to note that the information provided here is for educational purposes only and should not be construed as legal advice. Laws and regulations regarding estate planning, Last Will and Testament creation, and probate procedures may vary depending on jurisdiction and individual circumstances.

While efforts have been made to ensure the accuracy and reliability of the information presented, it is always advisable to consult with a qualified attorney or legal advisor who specializes in estate planning to obtain personalized guidance tailored to your specific situation.

Furthermore, the creation of a Last Will and Testament or other estate planning documents should be undertaken with careful consideration and understanding of the legal implications involved. Each individual's estate planning needs are unique, and professional legal assistance can help ensure that your wishes are accurately reflected and legally enforceable.

By accessing and using the information provided here, you acknowledge that the content is not a substitute for professional legal advice and that no attorney-client relationship is established through the use of this information.