Texas Last Will and Testament

State of Texas

State of Texas

Overview:

- Create Your Texas Last Will and Testament

- Understanding the Importance of a Last Will and Testament

- Simplified Explanation of Legal Concepts

- Key Requirements for a Valid Will in Texas

- Is Notarization Required for Your Texas Last Will?

- Types of Wills Recognized in Texas

- Is a Handwritten Last Will Valid in Texas?

- Sample of an Texas Last Will and Testament

- Benefits of Having a Last Will and Testament

- Consequences of Not Having a Last Will and Testament

- Requirements for Executors of Last Wills in Texas

- Creating Your Last Will and Testament

- Modifying or Canceling Your Last Will in Texas

- Navigating Probate in Texas

- Understanding Intestate Succession in Texas

- Understanding Estate and Inheritance Taxes in Texas

- FAQs About Texas Last Will and Testaments

- Testimonials

- Conclusion

- Download Your Texas Last Will and Testament

- Author's Expertise

- Legal References and Sources

- Legal Disclaimer

Create Your Texas Last Will and Testament

Crafting your Last Will and Testament in Texas is an essential step in ensuring your final wishes are upheld and your loved ones are provided for after you're gone. With a comprehensive understanding of Texas state laws and requirements, you can draft a legally binding document that reflects your intentions accurately. From appointing guardians for minors to distributing assets among beneficiaries, your Last Will and Testament serves as a crucial tool in estate planning.

By taking the time to create your Texas Last Will and Testament, you're taking proactive steps to protect your legacy and provide clarity for your family and beneficiaries. With careful consideration and attention to detail, you can create a document that offers peace of mind and ensures your wishes are honored according to Texas law.

Understanding the Importance of a Last Will and Testament

A Last Will and Testament holds significant importance in ensuring your final wishes are carried out and your assets are distributed according to your desires after you pass away. This legal document serves as a roadmap for your loved ones, providing clear instructions on how to manage your estate, care for dependents, and distribute property. Without a Will in place, state laws known as intestacy laws will dictate how your assets are distributed, which may not align with your wishes or the needs of your loved ones.

Moreover, a Last Will and Testament allows you to designate guardians for minor children, ensuring they are cared for by individuals you trust in the event of your untimely passing. By specifying beneficiaries and the distribution of assets, you can minimize potential conflicts among family members and provide for those closest to you. Additionally, a Will enables you to appoint an executor to oversee the administration of your estate, ensuring your wishes are carried out efficiently and according to the law.

Taking the time to create a Last Will and Testament offers peace of mind, knowing that your affairs are in order and your loved ones are provided for. It allows you to maintain control over your estate, protect your assets, and provide clear guidance to your family during a difficult time. Regardless of age or financial status, having a Will in place is a vital aspect of responsible estate planning and ensures that your legacy is preserved according to your wishes.

Simplified Explanation of Legal Concepts

Let's break down some essential legal terms related to creating a Last Will and Testament in Texas, aiming to simplify complex concepts for better comprehension.

-

Testator: The testator is the individual crafting the Will, serving as the primary architect of this crucial document. In Texas, anyone aged 18 or older and of sound mind can act as a testator.

-

Witnesses: Witnesses are individuals who observe the testator sign the Will and affirm its authenticity. Texas law requires witnesses to be at least 14 years old and not beneficiaries of the Will, ensuring the testator's intentions are accurately recorded.

-

Intestacy Laws: If someone passes away without a valid Will, Texas intestacy laws dictate how their estate is distributed. These laws prioritize spouses, children, and other close relatives, following a predetermined hierarchy.

-

Guardianship: This involves appointing a guardian for minor children in the event of both parents' deaths. Through a Will, the testator can designate a guardian to ensure the welfare and upbringing of their children aligns with their wishes.

-

Notarization: Notarization involves verifying the Will's execution by a notary public, confirming the signatories' identities and consent. While not mandatory in Texas, notarization can add an extra layer of authenticity to the document.

-

Beneficiaries: Beneficiaries are the individuals or entities named in the Will to receive the testator's assets. These may include family members, friends, or organizations chosen by the testator to inherit their estate.

- Estate Planning: Estate planning encompasses the strategic arrangement for managing and distributing one's assets after death. Drafting a Will is a fundamental aspect of estate planning in Texas, ensuring that the testator's wishes are carried out effectively.

Understanding these legal terms can facilitate the process of creating a Last Will and Testament in Texas, ensuring that your final wishes are accurately documented and legally upheld.

Key Requirements for a Valid Will in Texas

Crafting a valid Last Will and Testament in Texas entails adhering to specific requirements outlined by state law. Here are the key elements necessary for a Will to be legally binding in Texas:

-

Testamentary Capacity: The testator must be of sound mind and at least 18 years old to create a Will in Texas. They should understand the nature of their assets and the beneficiaries they wish to designate.

-

In Writing: A Will in Texas must be in writing to be valid, whether handwritten (holographic) or typewritten. Oral Wills, also known as nuncupative Wills, are not recognized in Texas except in limited circumstances.

-

Signature: The Will must be signed by the testator or by someone else at the testator's direction and in their presence. If the testator is physically unable to sign, they can direct another person to sign on their behalf, provided it's done in their presence and at their direction.

-

Witnesses: At least two competent witnesses must sign the Will in the presence of the testator. Witnesses must be at least 14 years old, mentally competent, and not beneficiaries of the Will or related to beneficiaries. Their role is to attest to the testator's signature and the Will's execution.

-

Notarization: While not required in Texas, having the Will notarized can provide additional evidence of its validity. A notary public can verify the identity of the testator and witnesses and confirm that they signed the document voluntarily.

-

Revocation: To ensure the validity of a Will, any prior Wills should be properly revoked. This can be done by physically destroying the old Will, creating a new Will with a revocation clause, or executing a separate document expressly revoking the previous Will.

- Compliance with Formalities: The Will should comply with all legal formalities prescribed by Texas law to be considered valid and enforceable.

By meeting these key requirements, individuals can create a legally binding Last Will and Testament in Texas, providing clarity and direction for the distribution of their assets upon their passing.

Is Notarization Required for Your Texas Last Will?

In Texas, notarization is not a strict requirement for a Last Will and Testament to be considered legally valid. However, having the Will notarized can provide additional evidence of its authenticity and may streamline the probate process. If the testator chooses to have their Will notarized, they must sign the document in the presence of a notary public, who will then affix their seal and signature to the Will. While notarization is optional, it can add an extra layer of assurance regarding the validity of the Will and may help prevent challenges to its authenticity during the probate proceedings.

Types of Wills Recognized in Texas

In Texas, several types of Wills are recognized, each serving different purposes and meeting specific legal requirements:

Attested Wills: This is the most common type of Will, also known as a formal or witnessed Will. To be valid, an attested Will must be in writing, signed by the testator or someone authorized to sign on their behalf, and witnessed by at least two credible witnesses who are present at the same time.

Holographic Wills: A holographic Will is entirely handwritten and signed by the testator but does not require witnesses. However, it must be entirely in the testator's handwriting to be considered valid in Texas.

Nuncupative Wills: Also known as oral or deathbed Wills, nuncupative Wills are spoken rather than written. However, they are subject to strict limitations in Texas and are only recognized in very specific circumstances, such as when made during the testator's last sickness or imminent peril of death and subsequently put into writing by a witness.

Self-Proved Wills: A self-proved Will is one in which the testator and witnesses execute a sworn affidavit before a notary public, affirming the validity of the Will. By doing so, the Will is considered self-proved, and the probate court can accept it as authentic without requiring further testimony from witnesses during probate proceedings.

Understanding the different types of Wills recognized in Texas allows individuals to choose the option that best suits their needs and circumstances, ensuring their final wishes are legally binding and properly executed.

Is a Handwritten Last Will Valid in Texas?

In Texas, several types of Wills are recognized, each serving different purposes and meeting specific legal requirements:

-

Attested Wills: This is the most common type of Will, also known as a formal or witnessed Will. To be valid, an attested Will must be in writing, signed by the testator or someone authorized to sign on their behalf, and witnessed by at least two credible witnesses who are present at the same time.

-

Holographic Wills: A holographic Will is entirely handwritten and signed by the testator but does not require witnesses. However, it must be entirely in the testator's handwriting to be considered valid in Texas.

-

Nuncupative Wills: Also known as oral or deathbed Wills, nuncupative Wills are spoken rather than written. However, they are subject to strict limitations in Texas and are only recognized in very specific circumstances, such as when made during the testator's last sickness or imminent peril of death and subsequently put into writing by a witness.

- Self-Proved Wills: A self-proved Will is one in which the testator and witnesses execute a sworn affidavit before a notary public, affirming the validity of the Will. By doing so, the Will is considered self-proved, and the probate court can accept it as authentic without requiring further testimony from witnesses during probate proceedings.

Understanding the different types of Wills recognized in Texas allows individuals to choose the option that best suits their needs and circumstances, ensuring their final wishes are legally binding and properly executed.

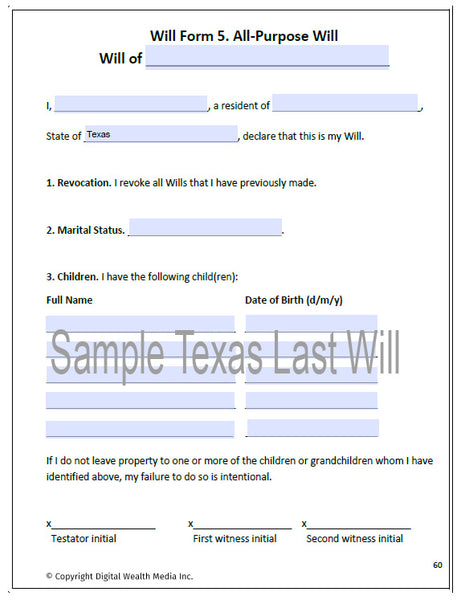

Sample of an Texas Last Will and Testament

Unlock the power of planning for your future with a sample Texas Last Will and Testament. This essential legal document lays the groundwork for how your assets are distributed and your final wishes honored. Click below to access a sample Will, and take the first step towards securing peace of mind for yourself and your loved ones.

Benefits of Having a Last Will and Testament

Intro: A Last Will and Testament is a crucial legal document that allows individuals to dictate how their assets and affairs should be handled after their passing. In Texas, having a well-crafted Will ensures that your final wishes are honored and your loved ones are provided for according to your instructions. Let's explore the key benefits of having a Last Will and Testament in Texas:

-

Asset Distribution: A Last Will and Testament in Texas enables you to specify how your assets and property should be distributed among your heirs and beneficiaries, ensuring that your wishes are legally binding and followed accurately.

-

Appointment of Guardians: You can use your Will to appoint guardians for any minor children, providing peace of mind that they will be cared for by individuals you trust in the event of your passing.

-

Conflict Prevention: By clearly outlining your intentions in a Will, you can help prevent conflicts and disputes among family members and other potential beneficiaries, minimizing the likelihood of legal battles over your estate.

-

Probate Streamlining: Having a Will can expedite the probate process in Texas by providing clear instructions for the distribution of your assets, potentially reducing the time and costs associated with administering your estate.

-

Cost Savings: A well-drafted Will can help minimize expenses related to estate administration, such as court fees and legal costs, ultimately preserving more of your estate for your beneficiaries.

-

Personal Legacy: Creating a Last Will and Testament allows you to leave behind a personal legacy and ensure that your values, beliefs, and priorities are reflected in how your assets are distributed.

-

Charitable Giving: If you have philanthropic goals, a Will allows you to include charitable bequests, enabling you to support causes and organizations that are important to you even after your lifetime.

-

Flexibility and Control: With a Will, you have the flexibility to update and revise your estate plan as needed, ensuring that it remains reflective of your current circumstances and preferences.

-

Executor Appointment: You can designate an executor in your Will to oversee the administration of your estate, providing guidance and direction for the distribution of your assets according to your wishes.

- Peace of Mind: Ultimately, having a Last Will and Testament offers peace of mind, knowing that you have taken proactive steps to provide for your loved ones and protect your legacy in Texas.

Consequences of Not Having a Last Will and Testament

-

Intestacy Laws: Without a Will, Texas intestacy laws will determine how your estate is distributed, which may not align with your wishes. In the absence of specific instructions, state laws typically prioritize distribution to spouses, children, and other close relatives, potentially leaving out individuals or organizations you intended to include.

-

Family Disputes: The lack of a Will can contribute to family disagreements and disputes over asset distribution. Without clear directives, family members may have conflicting interpretations of your intentions, leading to costly and emotionally draining legal battles.

-

Delayed Probate Process: Intestate estates often require a more complex and time-consuming probate process, as the court must follow state laws to determine asset distribution. This can result in delays in settling your estate and distributing assets to your heirs, causing unnecessary stress and financial strain for your loved ones.

-

Limited Control: Without a Will, you forfeit the opportunity to designate guardians for minor children or appoint trusted individuals to manage your estate. This lack of control may result in court-appointed guardianships or administrators who may not be in line with your preferences.

-

Increased Costs: Intestate estates may incur higher administrative costs, including court fees, attorney fees, and other expenses associated with probate proceedings. These costs can significantly reduce the value of your estate, leaving less for your beneficiaries to inherit.

-

Unintended Beneficiaries: Intestacy laws may designate beneficiaries whom you did not intend to inherit your assets. This could include distant relatives or individuals with whom you had no relationship, potentially leaving out close friends, charities, or other organizations you wished to support.

- Tax Implications: Failing to have a Will in place can lead to adverse tax consequences for your estate, as intestate estates may not benefit from tax-saving strategies or exemptions available through proper estate planning.

Requirements for Executors of Last Wills in Texas

In Texas, the role of an executor, often referred to as a personal representative, is vital in the administration of a Last Will and Testament. Executors are responsible for carrying out the wishes outlined in the Will and managing the estate's affairs following the testator's death. To serve as an executor in Texas, individuals must meet certain requirements and fulfill specific duties:

-

Legal Capacity: Executors must be at least 18 years old and of sound mind to serve in this capacity. Additionally, they cannot have a felony conviction unless their civil rights have been restored.

-

Residency: While Texas law does not explicitly require executors to be residents of the state, it is generally advisable to appoint someone who is familiar with Texas laws and procedures to facilitate the probate process.

-

Trustworthiness: Executors should be individuals whom the testator trusts to act in the best interests of the estate and its beneficiaries. They must demonstrate honesty, integrity, and competence in handling financial matters.

-

Understanding of Responsibilities: Executors should have a clear understanding of their duties and obligations under Texas law, including marshaling and managing estate assets, paying debts and taxes, distributing assets to beneficiaries, and filing necessary court documents.

-

Availability and Commitment: Serving as an executor requires a significant time commitment, especially during the probate process. Executors should be willing and available to dedicate the time and effort necessary to fulfill their duties promptly and efficiently.

-

Communication Skills: Executors must be able to effectively communicate with beneficiaries, creditors, attorneys, and other parties involved in the estate administration process. Clear and timely communication can help prevent misunderstandings and conflicts.

- Financial Literacy: Executors should have a basic understanding of financial concepts and be capable of managing estate assets prudently. While they may seek professional assistance from attorneys, accountants, or financial advisors, executors ultimately bear the responsibility for overseeing the estate's finances.

By meeting these requirements and responsibilities, executors play a crucial role in ensuring the orderly administration of Last Wills in Texas and the proper distribution of assets according to the testator's wishes.

Creating Your Last Will and Testament

When creating your Last Will and Testament in Texas, it's essential to approach the process with care and attention to detail. Your Will serves as a legally binding document that outlines your wishes regarding the distribution of your assets and the care of your loved ones after your passing. Here are some key steps to consider when creating your Will:

-

Determine Your Assets and Beneficiaries: Begin by making a comprehensive list of your assets, including real estate, financial accounts, personal property, and any other valuable possessions. Next, consider who you want to inherit these assets and how you wish to distribute them among your beneficiaries.

-

Choose an Executor: Select a trusted individual to serve as the executor of your Will. This person will be responsible for managing your estate, settling debts, and distributing assets according to your instructions. Make sure to discuss this role with your chosen executor beforehand to ensure they are willing and capable of fulfilling the responsibilities.

-

Specify Guardianship for Minor Children: If you have minor children, your Will allows you to designate a guardian to care for them in the event of your passing. Take the time to carefully consider who would be the most suitable guardian for your children and discuss this decision with the chosen individual.

-

Draft Your Will: While you can create a basic Will using online templates or software, it's advisable to seek assistance from a qualified estate planning attorney. They can help ensure that your Will complies with Texas state laws and accurately reflects your intentions. Be sure to include all necessary provisions, such as asset distribution, guardianship appointments, and any specific instructions or wishes you may have.

-

Sign and Execute Your Will: Once your Will is drafted, you must sign it in the presence of two witnesses who are not beneficiaries named in the Will. These witnesses must also sign the document to attest to its validity. While not required, you may choose to have your Will notarized to add an extra layer of authentication.

- Store Your Will Safely: After signing your Will, keep the original document in a secure location such as a safe deposit box or with your attorney. Make sure your executor knows where to find the Will and provide them with a copy for reference.

By following these steps and consulting with legal professionals as needed, you can create a Last Will and Testament that accurately reflects your wishes and provides peace of mind for you and your loved ones.

Modifying or Canceling Your Last Will in Texas

In Texas, modifying or canceling your Last Will and Testament is a straightforward process that allows you to update your estate plan as needed to reflect changes in your circumstances or preferences. Here are the key steps to consider when making modifications or revoking your Will:

-

Review Your Existing Will: Start by reviewing your current Will to identify any provisions that you wish to modify or revoke. Consider whether there have been any significant life events, such as marriage, divorce, birth of children, or changes in financial circumstances, that may warrant updates to your estate plan.

-

Determine the Changes: Decide what modifications you want to make to your Will, whether it involves adding new beneficiaries, changing asset distribution, appointing different executors or guardians, or updating specific instructions or bequests.

-

Execute a Codicil: If the changes to your Will are relatively minor, you may choose to execute a codicil, which is a legal document used to amend specific provisions of your existing Will while leaving the rest intact. A codicil must be signed and witnessed with the same formalities as a Will.

-

Create a New Will: If the changes to your estate plan are more substantial or if you prefer to start fresh, you can create a new Last Will and Testament that supersedes any previous versions. Be sure to clearly state in the new Will that it revokes all prior Wills and codicils.

-

Sign and Execute the Changes: Whether you're executing a codicil or a new Will, it's essential to follow the same formalities as when you initially created your Will. Sign the document in the presence of two witnesses who are not beneficiaries named in the Will, and have them sign as witnesses.

- Safely Store the Updated Will: After executing the changes, store the updated Will in a secure location along with any previous versions and related estate planning documents. Make sure to inform your executor or trusted loved ones about the changes and provide them with updated copies of the Will for reference.

By taking these steps to modify or cancel your Last Will and Testament in Texas, you can ensure that your estate plan accurately reflects your wishes and provides clear instructions for the distribution of your assets upon your passing. It's advisable to consult with an experienced estate planning attorney to ensure that the changes are executed properly and in compliance with Texas state laws.

Navigating Probate in Texas

Navigating probate in Texas can be a complex and time-consuming process, but understanding the key steps involved can help streamline the administration of an estate. Probate is the legal process through which a deceased person's assets are distributed to beneficiaries and heirs, and any outstanding debts and taxes are settled. In Texas, probate proceedings are typically overseen by the county probate court where the deceased person resided at the time of their death. The process begins with the filing of a petition for probate, which initiates formal court proceedings to validate the deceased person's Will and appoint an executor or administrator to manage the estate.

Once the probate process has been initiated, the executor or administrator is responsible for gathering and inventorying the deceased person's assets, appraising their value, paying off any outstanding debts and taxes, and distributing the remaining assets to beneficiaries according to the terms of the Will or Texas intestacy laws if there is no Will. Throughout the probate process, the executor or administrator must adhere to strict legal requirements and deadlines, including providing notice to creditors, filing inventories and accountings with the court, and obtaining court approval for certain actions, such as the sale of real estate or the distribution of assets.

While probate can be a time-consuming and costly process, there are strategies available to help expedite the administration of an estate and minimize expenses. For example, Texas offers several simplified probate procedures for small estates with assets below a certain threshold, as well as alternatives to formal probate administration, such as independent administration and muniment of title proceedings. Additionally, careful estate planning, including the use of trusts, beneficiary designations, and joint ownership arrangements, can help bypass probate altogether for certain assets, reducing the time and expense associated with the process. Consulting with an experienced probate attorney can provide invaluable guidance and support throughout the probate process, ensuring that the deceased person's final wishes are carried out efficiently and in accordance with Texas law.

Understanding Intestate Succession in Texas

When a person passes away without a valid Last Will and Testament, their estate is distributed according to the laws of intestate succession in Texas. Intestate succession is a predetermined set of rules that dictate how a deceased person's assets are distributed among their heirs when there is no Will to specify their wishes. In Texas, intestate succession laws prioritize certain family members as heirs, with spouses, children, parents, and siblings typically given priority in the distribution of assets.

If the deceased person is survived by a spouse but no children or parents, the entire estate usually goes to the surviving spouse. If there are children from the marriage, the spouse may inherit a portion of the estate, with the remainder divided among the children. If the deceased person has children from a previous relationship, the surviving spouse may receive a share of the estate, but the children are entitled to a portion as well. If there is no surviving spouse, the estate is typically divided among the deceased person's children, parents, or siblings, depending on who survives them.

In cases where no living relatives can be identified, the estate may escheat to the state of Texas. Intestate succession laws are designed to ensure that a deceased person's assets are distributed in a fair and orderly manner, but they may not always align with the deceased person's wishes. Creating a Last Will and Testament is the best way to ensure that your assets are distributed according to your preferences and to avoid the complexities of intestate succession. Consulting with an experienced estate planning attorney can provide valuable guidance in navigating these matters and ensuring that your estate plan reflects your wishes and priorities.

Understanding Estate and Inheritance Taxes in Texas

In Texas, there is no state estate tax or inheritance tax imposed on assets passed down to heirs. Unlike some other states, Texas does not levy taxes on the value of an estate upon death or on the inheritance received by beneficiaries. This absence of state-level estate and inheritance taxes can be advantageous for individuals planning their estates, as it simplifies the transfer of assets to heirs and reduces the overall tax burden on beneficiaries.

However, it's essential to note that while Texas does not impose its own estate or inheritance taxes, federal estate tax laws still apply to larger estates. As of 2022, the federal estate tax only applies to estates valued at more than $12.06 million per individual or $24.12 million for married couples, which means that the vast majority of estates are not subject to federal estate taxes. Additionally, assets passing to a surviving spouse or charity are typically exempt from federal estate tax.

Overall, understanding estate and inheritance tax laws, both at the state and federal levels, is crucial for effective estate planning in Texas. While Texas offers favorable tax treatment in terms of estate and inheritance taxes, consulting with a qualified estate planning attorney can help individuals navigate the complexities of estate tax laws and develop strategies to minimize tax liabilities while ensuring their assets are distributed according to their wishes.

FAQs About Texas Last Will and Testaments

Here are some frequently asked questions (FAQs) about Last Will and Testaments in Texas:

1. What is a Last Will and Testament, and why do I need one?

A Last Will and Testament is a legal document that outlines how you want your assets to be distributed after your death and appoints a personal representative to manage your estate. It's essential to have a Will to ensure that your wishes are carried out and to avoid disputes among your heirs.

2. Do I need an attorney to create a Will in Texas?

While it's not required to have an attorney to create a Will in Texas, consulting with a qualified estate planning attorney can ensure that your Will complies with state laws and accurately reflects your intentions. An attorney can also provide valuable guidance on estate planning strategies and help you avoid common pitfalls.

3. Can I write my own Will, or should I use a pre-made template?

While it's possible to write your own Will using a pre-made template or online software, it's essential to ensure that your Will meets all legal requirements and is properly executed. Errors or omissions in a homemade Will can lead to complications during probate and may result in your wishes not being carried out as intended.

4. How often should I update my Will?

It's advisable to review and update your Will periodically, especially after significant life events such as marriage, divorce, the birth or adoption of children, or changes in your financial situation. Updating your Will ensures that it remains current and accurately reflects your wishes.

5. What happens if I die without a Will in Texas?

If you die without a Will in Texas, your assets will be distributed according to the state's intestacy laws, which may not align with your wishes. In such cases, the court will appoint an administrator to manage your estate, and your assets will be distributed to your heirs based on a predetermined order of priority.

6. Can I disinherit someone in my Will?

Yes, you have the right to disinherit individuals from inheriting your assets in your Will. However, it's essential to consult with an attorney to ensure that your disinheritance wishes are properly documented and legally enforceable.

7. How do I ensure that my Will is valid in Texas?

To ensure that your Will is valid in Texas, it must be in writing, signed by you (the testator) in the presence of two witnesses who are at least 14 years old and of sound mind, and signed by the witnesses in your presence. Additionally, it's recommended but not required to have your Will notarized.

These FAQs provide general guidance on Last Will and Testaments in Texas, but it's essential to consult with a qualified estate planning attorney for personalized advice tailored to your specific circumstances.

Testimonials

Here are some testimonials from individuals who have successfully utilized the guidance provided in this article to create their Will:

Testimonial from Anthony Mack

"I am glad to see that someone has finally developed a Digital Will to help us get all of this information together. It will help ease the difficulty when we are no longer here. The whole digital thing is affecting us more and more, though I never gave much thought until a recent death"

Testimonial from Matthew Elder

“Everyone knows that having a will is essential, particularly when you have accumulated assets that would need to be transferred to rightful heirs after death. In today’s digital age, however, your assets also include the virtual – everything in cyberspace that can be considered your personal property, such as online accounts with financial institutions, governments, telecommunications services, travel booking tools. This cyber list also includes social-media accounts. The list may be very long.

Conclusion

In conclusion, creating a Last Will and Testament in Texas is a crucial step in ensuring that your final wishes are honored and your loved ones are provided for after your passing. By taking the time to carefully plan and document your intentions, you can minimize confusion, prevent family disputes, and streamline the distribution of your assets. Whether you choose to work with an attorney or use a DIY approach, the peace of mind that comes from having a legally binding Will in place is invaluable.

Furthermore, regularly reviewing and updating your Will is essential to reflect any changes in your life circumstances or financial situation. By staying proactive and keeping your Will current, you can adapt to life's changes and ensure that your estate plan remains relevant and effective. Ultimately, investing the time and effort into creating a comprehensive Will is a responsible decision that provides clarity and security for you and your loved ones in the future.

Download Your Texas Last Will and Testament

Ready to take control of your estate planning and ensure your final wishes are legally documented? Download our Texas Last Will and Testament today and begin the process of creating your personalized Will. With our user-friendly guide and customizable template, you can confidently outline your wishes for asset distribution, guardianship, and more. Don't leave your legacy to chance – secure your future and provide peace of mind for yourself and your loved ones by creating a legally binding Will tailored to your specific needs and preferences. Download now and start planning for tomorrow.

Author's Expertise

Ivon T. Hughes designed Digital Wealth Media to greatly simplify the process so that more people can enjoy the peace of mind and wealth-building power of asset protection.

To further educate and help people, there is a treasure trove of asset protection articles and videos on the Digital Wealth Media website, along with a variety of wealth-protection packages that include Wills and other legal documents, including Digital Wills, which are something that just became necessary recently due to the continued expansion of the Internet.

Legal References and Sources

For those seeking additional information or validation regarding estate planning in Texas, the following legal references and official government sources provide comprehensive insights into Texas state laws and procedures related to estate planning:

Texas Estates Code: The official website of the Texas Legislature offers access to the Texas Estates Code, which encompasses laws governing estate planning, Wills, and probate procedures in Texas.

Texas Probate Courts: The Texas Judicial Branch website provides resources and information on probate proceedings, estate administration, and related legal matters. It also offers access to court forms and instructions for creating a Last Will and Testament.

State Bar of Texas: The State Bar of Texas website offers guidance on estate planning, including articles, FAQs, and resources for finding qualified attorneys specializing in estate planning and probate law in Texas.

Texas Comptroller of Public Accounts: For information regarding estate taxes and other tax-related considerations relevant to estate planning in Texas, the Comptroller of Public Accounts website serves as an authoritative source.

Legal Aid Organizations: Legal aid organizations such as Texas Legal Services Center and Lone Star Legal Aid offer assistance and resources for low-income individuals seeking legal guidance on estate planning matters in Texas.

These legal references and sources serve as valuable resources for individuals seeking to understand and comply with Texas state laws governing estate planning and Last Will and Testament creation. It is advisable to consult these authoritative sources or seek professional legal advice for personalized guidance on specific estate planning issues in Texas.

Legal Disclaimer

The information provided on this website is intended for educational purposes and general guidance only. It does not constitute legal advice specific to the laws of the State of Texas or any other jurisdiction.

Laws related to estate planning, probate, and wills vary by state, and they are subject to change. The content presented here may not reflect the most current legal developments or regulations applicable in Texas.

Readers are strongly advised to seek the assistance of a qualified attorney or legal professional licensed in Texas to obtain personalized advice regarding their estate planning needs. Consulting with an attorney familiar with Texas laws ensures that individuals receive accurate information and guidance tailored to their unique circumstances.

No attorney-client relationship is established by reading or acting upon the information contained on this website. The authors, publishers, and distributors of this content disclaim any liability for reliance on the information provided herein or for any loss or damage resulting from its use.

It is essential to conduct thorough research and obtain professional legal advice before making any decisions related to estate planning, including creating a Last Will and Testament, in the State of Texas.